Wednesday, November 28, 2007

Without ability to borrow abroad, Washington cannot conduct its wars of aggression, and Americans cannot continue to consume $800B more than produces

11/28/07 "ICH" -- --- Hubris and arrogance are too ensconced in Washington for policymakers to be aware of the economic policy trap in which they have placed the US economy. If the subprime mortgage meltdown is half as bad as predicted, low US interest rates will be required in order to contain the crisis. But if the dollar’s plight is half as bad as predicted, high US interest rates will be required if foreigners are to continue to hold dollars and to finance US budget and trade deficits.

Which will Washington sacrifice, the domestic financial system and over-extended homeowners or its ability to finance deficits?

The answer seems obvious. Everything will be sacrificed in order to protect Washington’s ability to borrow abroad. Without the ability to borrow abroad, Washington cannot conduct its wars of aggression, and Americans cannot continue to consume $800 billion dollars more each year than the economy produces.

A few years ago the euro was worth 85 cents. Today it is worth $1.48. This is an enormous decline in the exchange value of the US dollar. Foreigners who finance the US budget and trade deficits have experienced a huge drop in the value of their dollar holdings. The interest rate on US Treasury bonds does not come close to compensating foreigners for the decline in the value of the dollar against other traded currencies. Investment returns from real estate and equities do not offset the losses from the decline in the dollar’s value.

China holds over one trillion dollars, and Japan almost one trillion, in dollar-denominated assets. Other countries have lesser but still substantial amounts. As the US dollar is the reserve currency, the entire world’s investment portfolio is over-weighted in dollars.

No country wants to hold a depreciating asset, and no country wants to acquire more depreciating assets. In order to reassure itself, Wall Street claims that foreign countries are locked into accumulating dollars in order to protect the value of their existing dollar holdings. But this is utter nonsense. The US dollar has lost 60% of its value during the current administration. Obviously, countries are not locked into accumulating dollars. ...

Monday, November 26, 2007

Energy prices are at all time highs. The US is deeply in debt and dependent on foreign creditors.

Pat Buchanan is too patriotic to come right out and say it, but the message of his new book, Day of Reckoning, is that America as we have known her is finished. Moreover, Naomi Wolf agrees with him. These two writers of different political persuasions arrive at America's demise from different directions.

Buchanan explains how hubris, ideology, and greed have torn America apart. A neoconservative cabal with an alien agenda captured the Bush administration and committed American blood, energy, and money to aggression against Muslim countries in the Middle East, while permitting America's domestic borders to be overrun by immigrants and exporting the jobs that had made the US an opportunity society. War and offshoring have taken a savage economic toll while open borders and diversity have created social and political division.

...

The Bush administration has been a catastrophe. Its failures are unprecedented. Energy prices are at all time highs. The US is deeply in debt and dependent on foreign creditors. The dollar has lost 60 per cent of its value against other tradable currencies, and its reserve currency status, the basis of American power, is in doubt. The US has lost millions of middle class jobs which have been replaced with low paid domestic service jobs. Except for the very rich, Americans have experienced no gains in real income in the 21st century. As the ladders of upward mobility are dismantled and the middle class struggles and fails, America is left with a few rich and many poor. America's reputation and credibility are damaged perhaps beyond repair. Congress and the press have enabled the executive branch's disregard of the Constitution and civil liberty. The US is mired in two lost wars which are pushing Lebanon and nuclear-armed Pakistan into deepening political crises.

As Buchanan concludes, "Our day of reckoning is at hand."

[is] the American superpower is also experiencing a terminal illness, with its decline marked by the dollar's downward drift

Great powers die slowly. It took years before the world realized that Great Britain was an imperial corpse, sapped of its strength by two world wars. The funeral finally occurred on Feb. 21, 1947, a freezing winter day in bomb-torn, bedraggled London, when the British wrote their own epitaph. ...

One has to wonder now whether the American superpower is also experiencing a terminal illness, with its decline marked by the dollar's downward drift. ... Yet the signs of imperial decadence are unmistakable. The world is losing confidence in the dollar, in no small part because it has lost confidence in America's strategic judgment and in its sustainability as a great power in the face of record budget and trade deficits, which are forcing the United States to borrow ever more money from future rivals like China and Russia. ...

... The irony for George W. Bush, of course, is that more than anything else he began as a president who wanted to build up American power, which he presumed to have been frittered away by Bill Clinton. ...

Wednesday, November 21, 2007

[India tech] shortage means something feared here: higher wages [+quality problems] ... [but static / declining wages in US ...ergo NO SHORTAGE?! ed.]

...

Nearly two decades into India's phenomenal growth as an international center for high technology, the industry has a problem: It's running out of workers.

There may be a lot of potential - Indian schools churn out 400,000 new engineers, the core of the high-tech industry, every year - but as few as 100,000 are actually ready to join the job world, experts say.

...

On the most basic level, it's a problem of success. The high-tech industry is expanding so fast that the population can't keep up with the demand for high-end workers.

...

A shortage means something feared here: higher wages.

...

India has technical institutes that seldom have electricity, and colleges with no computers. There are universities where professors seldom show up. Textbooks can be decades old. ...

most benefits from the H-1B visa program are not technology companies such Microsoft, IBM, ... but Indian outsourcing firms ...

The yearly rough and tumble for H-1B temporary workers' visas is in full swing this weekend, as the first day of the filing season is Monday, April 2. The year's allotment of 65,000 slots is anticipated to be exhausted in record time.

...

Yet, a BusinessWeek report, published Feb. 7, shed light on the fact that the companies that reap the most benefits from the H-1B visa program are not technology companies such Microsoft, IBM, Intel, Oracle and Sun Microsystems, which are usually associated with a large number of H-1B workers, but Indian outsourcing firms.

In reviewing visa data for the 2006 fiscal year, the report found that seven of the top 10 applicants were Indian companies that provided services to U.S. companies from India, from technology support to back-office processing. In fact, Infosys Technologies and Wipro took the top two spots for the second year in a row. Cognizant Technology Solutions, based in Teaneck, N.J., but operating mostly in India, took third place. The only other U.S. companies in the top 10 were Deloitte & Touche, an accounting and consulting firm, and Accenture, a consultancy, taking seventh and ninth place, respectively.

"brightest kids worrying about their jobs being outsourced. ... serious problems with the quality of bachelors from India, China ...

A commonly heard defense in the arguments that surround U.S. companies that offshore high-tech and engineering jobs is that the U.S. math and science education system is not producing a sufficient number of engineers to fill a corporation's needs.

However, a new study from Duke University calls this argument bunk, stating that there is no shortage of engineers in the United States, and that offshoring is all about cost savings.

This report, entitled "Issues in Science and Technology" and published in the latest National Academy of Sciences magazine further explores the topic of engineering graduation rates of India, China and the United States, the subject of a 2005 Duke study.

...

Duke's 2005 study corrected a long-heard myth about India and China graduating 12 times as many engineers as the United States, finding instead that the United States graduates a comparable number.

...

"You had the brightest kids worrying about their jobs being outsourced. We thought, if kids at Duke were worried, then let's do a study about what's going on in education," Vivek Wadhwa, executive in residence at Duke University's master's in engineering management program and a co-author of the study, told eWEEK at the time.

"The first thing you do in a study is you look at the facts. But we couldn't find any facts. The more we dug, the more we looked, the more we discovered there were no facts," said Wadhwa.

However, Duke's 2005 study reported serious problems with the quality of Indian and Chinese bachelor-level engineering graduates, and predicted both shortages in India and unemployment in China. The current report finds these predictions to be accurate, with China's National Reform Commission reporting that the majority of its 2006 graduates will not find work. There are also oft-heard whisperings of a engineering shortage in India, though private colleges and "finishing schools" are going far to make up for the Indian deficiencies, the report said. ...

At least 17 percent of computer programming, software engineering and data entry jobs were likely to be offshored ...

Updated: Over the next seven years, service offshoring is expected to have a relatively small impact on the overall U.S., but a sharply felt one on IT-concentrated metropolitan regions, finds a new report.

...

It was metropolitan areas with high concentrations of IT jobs, however, that were expected to be the hardest hit by service offshoring. Between 2005 and 2015, these IT-focused areas were expected to lose 2.6 percent of their jobs to offshoring, 2.4 percent in metropolitan areas that specialize in back-office services but only 1.9 percent of jobs in other metropolitan areas.

At least 17 percent of computer programming, software engineering and data entry jobs were likely to be offshored in these IT-concentrated metropolitan areas, including Bergen-Passaic and Newark in New Jersey; Boston; Boulder, Colo.; Danbury, Stamford and Hartford in Connecticut; Minneapolis; Orange County, San Francisco and San Jose in California and Wilmington, Del. ...

Thursday, November 15, 2007

United States spent nearly $1 trillion on security in fiscal year 2007 ... not just the $463B for the DoDefense ...

Back in February 2006, the Bush administration requested, and Congress later approved, roughly $463 billion in funding for the Defense Department. But when it comes to what American taxpayers really spend on national security, this is just the tip of the iceberg. All told, the United States spent nearly $1 trillion on security in fiscal year 2007, which ended on September 30.

In addition to the money allocated to the Pentagon each year as part of the Defense Department’s “base budget,” hundreds of billions of dollars are spent on other federal programs that are a direct result of the United States supporting and maintaining its military.

For example, the United States spent $173 billion last year on the wars in Iraq and Afghanistan and other costs the Pentagon says are related to the “Global War on Terror.” ...

The government also spent $43 billion on homeland security, not including $17 billion funded through the Defense Department budget. ...

The White House further revealed that it spent $43 billion on intelligence-related activities last year. ...

Veterans’ benefits accounted for $73 billion in federal spending last year to provide for those who’ve served their country in the past. ...

And the list goes on. According to the White House, the government paid $433 billion in interest on the national debt, and a conservative estimate puts the cost of past military spending attributable to this debt at $99 billion annually. ...

New JEC Report Reveals Total Economic Costs of War Could Exceed $3.5 Trillion if U.S. Stays the Course

November 13: Senate Majority Leader Harry Reid (D-NV) and House Majority Leader Steny Hoyer (D-MD) will join Joint Economic Committee (JEC) Chairman Charles E. Schumer (D-NY), and JEC Vice Chair Carolyn Maloney (D-NY) today released a new report exposing the hidden costs of the war in Iraq. The Joint Economic Committee report investigates the costs of the war in Iraq that are not included in direct budgetary appropriations, including long term veteran’s health care, foregone investment, oil market disruptions and interest payments on borrowed war funding. The JEC estimates these costs could total in the trillions of dollars. ...

83 percent of crushing federal debt is a product of past three GOP presidents

Schumer and Maloney Urge White House to Stop Loading Future Generations with Backbreaking Debt

Washington, D.C. – Senator Charles E. Schumer, Chairman of the Joint Economic Committee (JEC) and Rep. Carolyn B. Maloney, Vice Chair of the JEC released a new JEC and House Budget Committee analysis of total national and public debt incurred under the past five administrations. The analysis highlights a proven track record of fiscal responsibility under Democratic administrations, and conversely a sharp increase in debt under Republican administrations.

The great majority of our national debt has been incurred by the past three Republican administrations. Over the past thirty years, those administrations have borrowed an average of $233 billion each year from the public. In contrast, under Democratic administrations the Federal government has borrowed an average of $26 billion each year, just one-ninth as much. ...

Wednesday, November 14, 2007

wars in Iraq and Afghanistan have thus far cost the average U.S. family of four more than $20,000

The economic costs to the United States of the wars in Iraq and Afghanistan so far total approximately $1.5 trillion, according to a new study by congressional Democrats that estimates the conflicts' "hidden costs"-- including higher oil prices, the expense of treating wounded veterans and interest payments on the money borrowed to pay for the wars.

That amount is nearly double the $804 billion the White House has spent or requested to wage these wars through 2008, according to the Democratic staff of Congress's Joint Economic Committee. Its report, titled "The Hidden Costs of the Iraq War," estimates that the wars in Iraq and Afghanistan have thus far cost the average U.S. family of four more than $20,000. ...

...

The report argues that war funding is diverting billions of dollars away from "productive investment" by American businesses in the United States. It also says that the conflicts are pulling reservists and National Guardsmen away from their jobs, resulting in economic disruptions for U.S. employers that the report estimates at $1 billion to $2 billion. ...

Tuesday, November 13, 2007

Why Americans Don’t Study Science—It Doesn’t Pay ... pursuing an advanced degree in these fields is a bad investment.

...

There they go again. Claiming they can’t find enough skilled Americans, the high-tech industry has browbeaten Congress into allowing them to bring in another 20,000 foreign workers. The little-noticed legislation, inserted into an appropriations bill required for the government to continue normal operations, expands the number of foreign workers eligible for H-1b visas from 65,000 to 85,000 in 2005.

...

But native enrollment in graduate S&E programs peaked at 330,148 in 1993. Not coincidentally, 1993 was also the year in which S&E unemployment spiked at 3.5 percent. And, although unemployment fell during the 1990s boom, salaries in S&E occupations lagged those of other professional fields.

The reason Americans hesitate to study science and engineering is simple: pursuing an advanced degree in these fields is a bad investment.

For PhDs for example, the salary premium is not high enough to compensate for the five or more years of foregoing an industry salary while pursuing graduate study.

For U.S. citizens a doctorate in science or engineering causes a net lifetime LOSS in earnings.

For foreigners, of course, an American S&E degree remains attractive—relative to their options at home.

Allowing the importation of cheaper foreign workers is simply a form of corporate welfare for the high-tech industry—and it’s a solution that, by flooding the S&E market and discouraging potential native-born students, makes the problem worse.

Edwin S. Rubenstein (email him) is President of ESR Research Economic Consultants in Indianapolis.Engineer Shortage? Duke Study Says No ... real issue is cheap overseas labor

Morning Edition, April 30, 2007 · Why are so many engineering jobs being sent overseas? Leaders of tech companies say the United States does not produce enough engineers. But a Duke University study says the real issue is cheap overseas labor. Vivek Wadhwa discusses his study's findings.

US’ education system produces a supply of qualified STEM graduates in much greater numbers than jobs available ...less attractive career opportunities

Dr. Harold Salzman tells a House subcommittee on innovation and technology that new perspectives on competition and new routes for sharing knowledge freely across borders have prompted firms and universities to globalize. Salzman argues that globalization is not prompted by any deficiencies in the domestic supply of trained workers, and that "techno-nationalist" policies of the past are outdated and ineffective.

...

science, technology, engineering, and mathematics (STEM) workforce ...

...

The available data indicate that the United States’ education system produces a supply of qualified STEM graduates in much greater numbers than jobs available. If there are shortages, it is most likely a demand-side problem of STEM career opportunities that are less attractive than career opportunities in other fields. However, standard labor market indicators do not indicate any shortages.

...

The standard education measures indicate there are enough students with the requisite skills to succeed in science and engineering courses of study, and managers we have interviewed rarely if ever note a lack of technical skills among their STEM workers.

...

Supply and Demand for STEM workers

Common to many policy reports is a call for large increases in the STEM workforce, and improvement in K-12 math and science as the means of achieving this increase.4 The data do not reflect the claim that U.S. students show declining interest in science and engineering fields, either in college or in entering the workforce.

...

From 1985 to 2000, the United States graduated about 435,000 S&E students annually with bachelor’s, master’s, and doctoral degrees—that total includes only U.S. citizens and permanent residents (about 72 percent of STEM workers hold a bachelor’s, 20 percent a master’s, and 7 percent a doctorate degree). Over the same period, the net change in STEM occupational employment ran about 150,000 annually, such that the average ratio of all STEM graduates to net employment change was about three to one.

...

... However, there is a surprisingly low rate of STEM retention for the 1993 to 2001 cohorts of STEM graduates.

...

For example, in a bid to increase visa caps, a number of high-tech CEOs discussed the demand their companies had for U.S.-based science and engineering workers to a Wall Street Journal reporter in June, 2006:

- Mr. McNealy says Sun does 75% to 80% of its research and development in the U.S. Craig Barrett, chairman of Intel Corp., says his company also employs most of its researchers in the U.S. and wants to keep it that way. The reasons? … “If engineering is happening here in the U.S., I think my children will have a richer work environment.” (Wall Street Journal 2006)

- Sun Microsystems Inc. has chosen four of its facilities around the world to take the place of its Silicon Valley office as the research and development hub…. “We are over-invested in high-cost geographies like the U.S., and underinvested in low-cost geographies like India,” … the company's senior vice president of global engineering told reporters in Bangalore. [He] said the company will not lay off programmers in the U.S.—but won't hire many, either.… The company has reduced its staff to about 30,000, from roughly 43,000 four years ago. (Associated Press 2005; emphasis added)

Current policy is driven by the twin perceptions of a labor market shortage of scientists and engineers and of a pool of qualified students that is small in number and declining in quality. Math and science education are viewed as the primary policy levers to increase labor market supply, supplemented by increased immigration. But the data show little evidence to support those positions, and, in fact, indicate an ample supply of students whose preparation and performance has been increasing over the past decades. We are concerned that the consensus prescriptions are based on some misperceptions about efficient and sustainable strategies for economic and social prosperity. ...

80% of H1-B visas going to Indian-owned outsourcing companies last year .. [supposed to help US companies get short skills !!]

...

Many other individuals and companies also expected to fulfill one of the key reasons for the program: to bring needed skills to the United States. Companies send representatives around the world to recruit the best and the brightest that they can find.

But something unusual happened last year and this year.

In past years a large percentage of H-1B visas have been granted to citizens of India. Only 7.5% of H-1B's were granted to Indian nationals in 1992, but that had jumped to about 40% in 2005 and then to 43,167 (66.5%) of the 65,000 in 2006. The trend has been strongly toward Indian companies obtaining the H-1B visas, with eight of every ten visas going to Indian-owned outsourcing companies last year.

In 2005 it was four in ten.

Alone, that statistic is a little bit surprising. After all, the program is intended to benefit U.S. companies in need of critical skills.

In fact, by definition, the visas granted are not supposed to displace American workers.

But what has happened is that the vast majority of H-1B visas appear to be going to Indian outsourcing companies. ...

cannot use the H-1B visa as a "cheap labor" program: evidence that Indian IT companies seeking H-1B visas may have paid lower wages than US companies

...

The H-1B visa program has been a hot topic in the tech industry for several years. The issue is boiling over again because of a dramatic rise in overseas outsourcing, which is costing thousands of U.S. workers their jobs, and the presidential election campaign.

...

H-1B visas are supposed to be gap fillers, allowing companies to find well-educated employees when they run into trouble hiring qualified U.S. workers. Critics have charged, however, that some companies are using them on a constant basis to cut costs. Also, the visas are intended to help U.S. employers stay competitive, but Hira said his research shows their use by foreign-based companies has accelerated the shift of tech work abroad.

...

Hira surmised that Infosys, Satyam and Wipro all fit the category of "H-1B dependent" employers based on their public statements. Organizations with at least 51 full-time employees in the United States were defined as H-1B dependent if 15 percent or more of their workers were holders of that visa.

...

Miller found nothing inherently wrong with a high proportion of H-1Bs at the Indian companies. "There's nothing in the law, that I'm aware of, that says a company can't have 100 percent" of their employees on H-1B visas, he said. The key, he said, is that the employer cannot use the H-1B visa rules as a "cheap labor" program.

Hira, though, presents evidence that Indian IT companies seeking H-1B visas may have paid lower wages than U.S. counterparts. For example, for the year ending Sept. 30, 2001, Wipro requested a total of 3,120 H-1Bs, and pledged to pay a total of $158 million in wages, for an average annual wage of $50,648, Hira found. EDS requested a total 452 H-1Bs and pledged to pay $32 million in wages, for an average annual wage of $71,251, according to the study. ...

Monday, November 12, 2007

Oil: trading on exchanges like the New York Mercantile Exchange, or Nymex, is contributing “enormously” to high prices ... India’s petroleum secretary

NEW DELHI, Nov. 7 — As oil approaches the $100-a-barrel milestone, M. S. Srinivasan, India’s petroleum secretary, has an unorthodox recommendation for cooling overheated prices: halt trading of crude oil on commodity exchanges.

There are “no supply constraints right now, and demand has not escalated out of control,” Mr. Srinivasan said in a recent interview in his New Delhi office. Rather, trading on exchanges like the New York Mercantile Exchange, or Nymex, is contributing “enormously” to high prices, he said.

If crude was eliminated from the commodities traded on Nymex, Mr. Srinivasan predicted, the world would “see a drastic reduction in the price.” The benchmark price of crude touched $98.10 on Nymex on Wednesday, a new record, before retreating to $96.37.

Mr. Srinivasan’s idea is based on a widely held belief that investors are artificially driving up oil prices. Hedge funds, banks and pension funds have poured capital into oil trading in recent years, betting that demand will increase. Analysts say these bets have become self-fulfilling prophecies, helping to push prices higher.

What analysts cannot agree on is how much of the increase is attributable to the investors — estimates vary from $10 a barrel to over $30 a barrel — and what, if anything, should be done about it. ...

underpinnings of the Bush economy are terrible : Median income stagnant, purchases up 18% ... How? Tons of debt

...

Yet last week the economic news was upbeat. The U.S. economy grew 3.9 percent and the economy added 166,000 jobs. Shouldn't people be happy about those developments?

The answer is no they shouldn't. As I noted in the first installment in this series, job and wage growth for this expansion is poor at best. Simply put, if you hadn't had a meaningful raise for the duration of "greatest story never told" you'd be frustrated, too. But that poor job and pay growth only tell part of the story. The bottom line is the underpinnings of the Bush economy are terrible -- and they are starting to come home to roost in a big way.

...

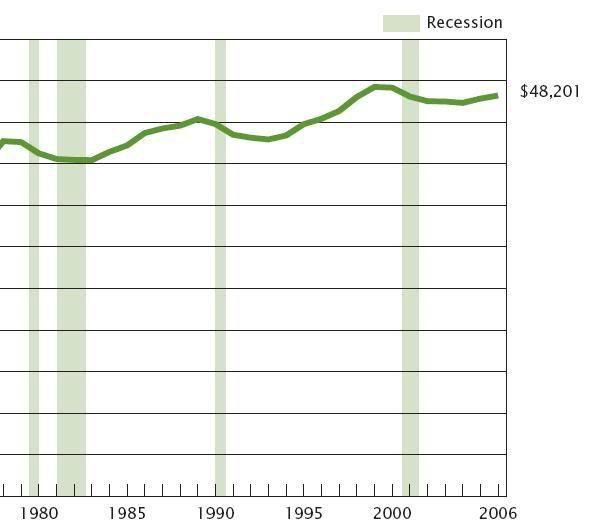

Notice how the median national income has stagnated? Yet over the duration of this expansion, personal consumption expenditures have increased 18.34 percent in chained (inflation-adjusted) dollars. So, at the beginning of this expansion people were already spending everything they made on a weekly basic. Over the last seven years income has stagnated, yet people have increased their purchases by 18.34 percent. Where did all this new money come from?

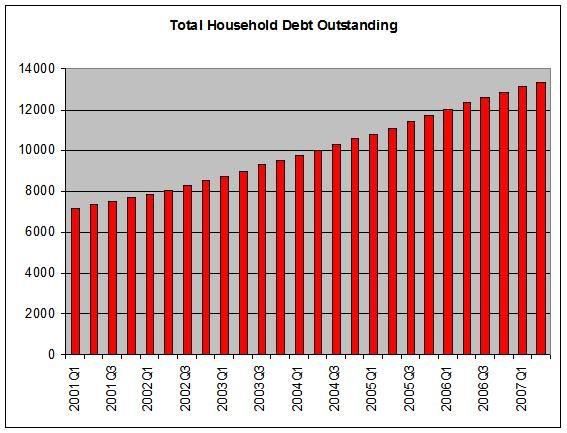

Tons of debt. Here is a chart compiled from information from the Federal Reserve's Flow of Funds Report.

...

Let's put some figures on that chart. In the fourth quarter of 2001, total household debt outstanding totaled $7.680 trillion dollars. In the second quarter of 2007, total household debt outstanding increased to $13.331 trillion -- a 73.56 percent increase.

Let's place those figures in perspective.

In the fourth quarter of 2001, total household debt was 75.10 percent of GDP. In the second quarter of 2007 it was 96.82 percent

...

The problem with this debt is we have now partially crippled our economy going forward. ...

Elites need to stop denying the breadth and reach of economic pain caused by America's integration with a much poorer global economy

For years Americans have been told that they all benefit from trade with poorer countries - yet many now find they are worse off.

These poll results, however, should not surprise anyone who understands the economics of trade. Chapter one of the trade textbook was essentially written by David Ricardo, and it does indeed teach that trade, on the basis of comparative advantage, typically boosts a nation's average income. ...

Sadly, both for American workers and the quality of the trade debate, the textbook has other chapters. One of them explains the Stolper-Samuelson Theorem (SST), which points out that when the US exports insurance services and aircraft while importing apparel and electronics, we are implicitly selling capital - physical and human - for labour. This exchange bids up capital's price (profits and high-end salaries) and bids down wages for the broad working and middle-class, leading to rising inequality and downward wage pressure for many Americans.

Note that this is not just a story about laid-off factory workers, who obviously suffer the toughest losses. Rather, all workers in the US economy who resemble import-displaced workers in terms of education, skills, and credentials are affected. Landscapers won't lose their jobs to imports, but their wages are lowered through competition with those import-displaced factory workers.

...

Lastly, we - and "we" here refers to the economic elites in both parties playing guard-dog for the trade status quo - need to stop denying the breadth and reach of economic pain caused by America's integration with a much poorer global economy. The polls are telling us something pretty ironic: the people have read ahead of us in the trade textbook. We'd better catch up.

...

Alternative Tax Showdown: Their defense of the [private equity] morally indefensible tax breaks is tawdry. ... contributed $11.8 million to candidate

...

Under current tax law, 23 million taxpayers will owe the alternative tax for 2007, up from 4 million last year. The tax was originally intended to apply to multimillionaires. But most of this year’s alternative taxpayers make between $100,000 and $500,000 and about a third make less than $100,000. They all have good cause to feel rooked and to expect help from Congress. ...

...

The House tax committee met the challenge, drafting a bill that provides the needed tax relief and plugs the resulting budget gap, mainly by raising taxes on private equity partners and hedge fund managers. The bill is good policy. The tax relief assuages justifiably aggrieved taxpayers. Tax increases on private equity firms and hedge funds rectify outdated rules that have allowed the very wealthiest to enjoy tax rates lower than those paid by middle-income Americans and, in some cases, to defer taxes indefinitely.

...

But key Democratic senators, among them New York’s Charles Schumer, who is the main fund-raiser for Senate Democrats, are balking. They know they must provide alternative tax relief, but they don’t want to tax private equity and hedge funds to pay for it. Their defense of the industries’ morally indefensible tax breaks is tawdry. As The Washington Post reported yesterday, in the first nine months of 2007, as pressure built to dismantle the tax breaks, investment firms and hedge funds contributed $11.8 million to candidates, party committees and leadership political action committees. That’s more than was given in 2005 and 2006 combined. More than two-thirds of that money went to Democrats. ...

“wealth creating” components of the economy have been subordinated to a finance-driven model which suddenly derailed due to abusive expansion of debt

...

Why do the banks need such a huge infusion of credit if they are as “rock solid” as Bernanke says?

As most people now realize, the mortgage industry is on life-support. ...

...

Additionally, the banks are holding an estimated $200 billion in mortgage-backed securities and derivatives for which there is currently no market. This is compounded by $350 billion in “off balance sheets” operations — which are collateralized with dodgy long-term mortgage-backed securities — that provide funding for “short-term” asset-backed commercial paper. ASCP has shriveled by $275 billion in the last 10 weeks leaving the banks with gargantuan liabilities. ...

...

The news is bleak. The systemic rot is appearing everywhere presaging ongoing losses for the financial giants and a long-downward spiral for the markets. The banks are currently under-regulated, over-leveraged and under capitalized. ...

...

Former Fed chief Paul Volcker summarized the overall economic situation last week at the second annual summit of the Stanford Institute for Economic Policy Research. In his speech he said:

Altogether, the circumstances seem as dangerous and intractable as I can remember. Boomers are spending like there is no tomorrow. Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security.. As a Nation we are consuming about 6 per cent more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 billion per day.” The nation is facing “huge imbalances and risks.

Volcker is right. The country is in a bigger pickle than any time in its 230 year history. ...

...

The biggest losers of all, however, are the financial giants that created most of the abstruse, debt-instruments that are now devouring the system from within. The productive and “wealth creating” components of the economy have been subordinated to a finance-driven model which suddenly derailed due to the abusive expansion of debt. Inevitably, some of the banks that took the greatest risks will be shuttered and trillions of dollars in market capitalization will disappear. ...

...

... The pervasive “free market” ideology rejects the notion of supervision or oversight, and as a result, the markets have become increasingly opaque and unresponsive to rules that may assure their continued credibility or even their ability to function properly.

The “supply side” avatars of deregulation have transformed the world’s most vital and prosperous markets into a huckster’s shell-game. All regulatory accountability has vanished along with trillions of dollars in foreign investment. What’s left is a flea-market for dodgy loans, dubious over-leveraged equities and “securitized” Triple A-rated garbage.

Let’s hear it for the Reagan Revolution. ...

Federal Liabilities Now Equal $175,000 for Every American

(CNSNews.com) - Deficit spending and promised benefits for federal entitlement programs have put every man, woman, and child in the United States on the hook for $175,000, says a new report by David Walker, comptroller general of the United States. ...

The damage done to the American economy ...repercussions will be felt beyond the lifetime of anyone reading this page

The next president will have to deal with yet another crippling legacy of George W. Bush: the economy. A Nobel laureate, Joseph E. Stiglitz, sees a generation-long struggle to recoup.

When we look back someday at the catastrophe that was the Bush administration, we will think of many things: the tragedy of the Iraq war, the shame of Guantánamo and Abu Ghraib, the erosion of civil liberties. The damage done to the American economy does not make front-page headlines every day, but the repercussions will be felt beyond the lifetime of anyone reading this page.

I can hear an irritated counterthrust already. The president has not driven the United States into a recession during his almost seven years in office. Unemployment stands at a respectable 4.6 percent. Well, fine. But the other side of the ledger groans with distress: a tax code that has become hideously biased in favor of the rich; a national debt that will probably have grown 70 percent by the time this president leaves Washington; a swelling cascade of mortgage defaults; a record near-$850 billion trade deficit; oil prices that are higher than they have ever been; and a dollar so weak that for an American to buy a cup of coffee in London or Paris—or even the Yukon—becomes a venture in high finance.

And it gets worse. After almost seven years of this president, the United States is less prepared than ever to face the future. We have not been educating enough engineers and scientists, people with the skills we will need to compete with China and India. We have not been investing in the kinds of basic research that made us the technological powerhouse of the late 20th century. And although the president now understands—or so he says—that we must begin to wean ourselves from oil and coal, we have on his watch become more deeply dependent on both. ...

...

... A budget surplus of 2.4 percent of gross domestic product (G.D.P.), which greeted Bush as he took office, turned into a deficit of 3.6 percent in the space of four years. The United States had not experienced a turnaround of this magnitude since the global crisis of World War II.

Agricultural subsidies were doubled between 2002 and 2005. Tax expenditures—the vast system of subsidies and preferences hidden in the tax code—increased more than a quarter. Tax breaks for the president’s friends in the oil-and-gas industry increased by billions and billions of dollars. ... In a nutshell, money was being spent everyplace except where it was needed. During these past seven years the percentage of G.D.P. spent on research and development outside defense and health has fallen. Little has been done about our decaying infrastructure—be it levees in New Orleans or bridges in Minneapolis. ...

...

... You’ll still hear some—and, loudly, the president himself—argue that the administration’s tax cuts were meant to stimulate the economy, but this was never true. The bang for the buck—the amount of stimulus per dollar of deficit—was astonishingly low. ... Credit was shoveled out the door, and subprime mortgages were made available to anyone this side of life support. Credit-card debt mounted to a whopping $900 billion by the summer of 2007. ...

... The president undoubtedly hoped the reckoning would come sometime after 2008. It arrived 18 months early. As many as 1.7 million Americans are expected to lose their homes in the months ahead. ...

...

America’s budget and trade deficits have grown to record highs under President Bush. To be sure, deficits don’t have to be crippling in and of themselves. If a business borrows to buy a machine, it’s a good thing, not a bad thing. During the past six years, America—its government, its families, the country as a whole—has been borrowing to sustain its consumption. Meanwhile, investment in fixed assets—the plants and equipment that help increase our wealth—has been declining.

...

In short, there’s a momentum here that will require a generation to reverse. Decades hence we should take stock, and revisit the conventional wisdom. Will Herbert Hoover still deserve his dubious mantle? I’m guessing that George W. Bush will have earned one more grim superlative.

...

Thursday, November 8, 2007

103,000 of [the new jobs], before seasonal adjustment — were added by the statisticians, not reported by employers

Today’s employment report is mediocre at best. But to understand that, you have to look past the headline numbers.

Those numbers say that the government’s survey of employers showed a gain of 130,000 private sector jobs, on a seasonally adjusted basis, in October. That seems to be better than in recent months.

I don’t believe it. Most of those jobs — 103,000 of them, before seasonal adjustment — were added by the statisticians, not reported by employers. (It should be noted that, before seasonal adjustment, there were 201,000 jobs added, so this is just more than half.)

Why add jobs? It is an effort to include jobs created by new companies not surveyed, less an estimate for jobs lost at companies that went out of business and therefore did not respond to the survey.

Of those 103,000 jobs, 14,000 were in the construction industry, and 25,000 were in finance. Does anyone believe that all those new companies are being created in those industries now? (You can see the government’s explanation for this here.) ...

Fears of dollar collapse as Saudis take fright

Saudi Arabia has refused to cut interest rates in lockstep with the US Federal Reserve for the first time, signalling that the oil-rich Gulf kingdom is preparing to break the dollar currency peg in a move that risks setting off a stampede out of the dollar across the Middle East.

"This is a very dangerous situation for the dollar," said Hans Redeker, currency chief at BNP Paribas.

"Saudi Arabia has $800bn (£400bn) in their future generation fund, and the entire region has $3,500bn under management. They face an inflationary threat and do not want to import an interest rate policy set for the recessionary conditions in the United States," he said. ...

Shouldn't We Talk About... Manufacturing Jobs? ... net job loss last month (including 47,000 lost manufacturing jobs),

...

But we've heard nothing more than whispers about jobs so far. With an unsettled market, a mortgage and housing mess, massive trade deficits, and net job loss last month (including 47,000 lost manufacturing jobs), that should change -- and change soon. We need a national strategy to grow jobs, spur domestic innovation, and strengthen our manufacturing base.

We need to jumpstart the talk about jobs. That's why the Alliance for American Manufacturing (AAM) has partnered with actor John Ratzenberger (of Cheers fame and Travel Channel's Made in America show) to host a national series of seven "Keep It Made In America" Town Hall meetings this fall. ...

Wednesday, November 7, 2007

When half of our population trying to make it on 12 percent of the nation's payroll can no longer meet the interest payments, ... happy doomsday ...

It was almost 100 years ago that Henry Ford startled the world by giving his workers a raise without being asked. He explained that if they didn't have money they could not buy Ford automobiles.

From then on, his self-evident bit of common sense was accepted decade after decade. But in recent years it got lost and forgotten. The big boys have stopped giving us little folks enough to buy the big boys' stuff.

Get this from the Wall Street Journal: "The wealthiest 1% of Americans earned 21.2% of all income in 2005, according to new data from the Internal Revenue Service. That is up sharply from 19% in 2004, and surpasses the previous high of 20.8% set in 2000, at the peak of the previous bull market in stocks. The bottom 50% earned 12.8% of all income, down from 13.4% in 2004 and a bit less than their 13% share in 2000."

...

Should we reach the point where the half of our population trying to make it on 12 percent of the nation's payroll can no longer meet the interest payments, we shall have a crisis where all the choices are worse than awful. And a happy doomsday to you, too.

The dollar has plummeted in value, more so in Bush's term than during any comparable period of U.S. history. ...

11/04/07 -- -- - The euro, worth 83 cents in the early George W. Bush years, is at $1.45.

The British pound is back up over $2, the highest level since the Carter era. The Canadian dollar, which used to be worth 65 cents, is worth more than the U.S. dollar for the first time in half a century.

Oil is over $90 a barrel. Gold, down to $260 an ounce not so long ago, has hit $800.

Have gold, silver, oil, the euro, the pound and the Canadian dollar all suddenly soared in value in just a few years?

Nope. The dollar has plummeted in value, more so in Bush's term than during any comparable period of U.S. history. Indeed, Bush is presiding over a worldwide abandonment of the American dollar.

...

In 2006, that U.S. trade deficit hit $764 billion. The current account deficit, which includes the trade deficit, plus the net outflow of interest, dividends, capital gains and foreign aid, hit $857 billion, 6.5 percent of GDP. As some of us have been writing for years, such deficits are unsustainable and must lead to a decline of the dollar.

...

The oil-producing and exporting nations, with trade surpluses, like China, have also begun to take the stash of dollars they have and stuff them into sovereign wealth funds, and use these immense and growing funds to buy up real assets in the United States -- investment banks and American companies.

Nor is there any end in sight to the sinking of the dollar. For, as foreigners demand more dollars for the oil and goods they sell us, the trade deficit will not fall. And as the U.S. government prints more and more dollars to cover the budget deficits that stretch out -- with the coming retirement of the baby boomers -- all the way to the horizon, the value of the dollar will fall. And as Ben Bernanke at the Fed tries to keep interest rates low, to keep the U.S. economy from sputtering out in the credit crunch, the value of the dollar will fall.

The chickens of free trade are coming home to roost.

Tuesday, November 6, 2007

insisting that she be paid in almost any currency but the U.S. dollar

Gisele Bundchen wants to remain the world's richest model and is insisting that she be paid in almost any currency but the U.S. dollar.

Like billionaire investors Warren Buffett and Bill Gross, the Brazilian supermodel, who Forbes magazine says earns more than anyone in her industry, is at the top of a growing list of rich people who have concluded that the currency can only depreciate because Americans led by President George W. Bush are living beyond their means. ...

Friday, November 2, 2007

"the CEOs of Exxon, Texaco, and Shell for figuring out how to quadruple the price of oil over a seven-year period without an actual shortage."

Gasoline prices are poised to explode again. Oil companies are setting up the framework for higher prices because of fears of a Turkish invasion of Kurdish-controlled northern Iraq and administration saber rattling about Iran. Crude oil, at $29.59 a barrel when President Bush took office in January 2001, is now pushing toward $100. Washington state's current gasoline cost of $3.09 per gallon, double Seattle's 2001 price of $1.52, is now second only to California in the 48 contiguous states.

Jay Leno joked on "The Tonight Show" Oct. 17, "The Nobel Prize for economics was awarded to three people -- the CEOs of Exxon, Texaco, and Shell for figuring out how to quadruple the price of oil over a seven-year period without an actual shortage."

...

... Oil companies raised gas prices 24 cents a gallon in the 24 hours after Katrina. The FTC reported increases "not substantially attributable to increased costs." It was pure fear mongering.

...

However, there is no "violation" if the price charged is "substantially attributable to local, regional, national, or international market conditions." The House is saying it is not gouging if the public will bear it. The oil companies could still charge whatever they want -- a loophole big enough for a gas-guzzling Mack truck. ...

Workers' retirement-plan participation declines ... drops from 44% in 2000 to 40% in 2006 ...

SAN FRANCISCO (MarketWatch) -- Thanks in part to fewer employers enrolling their workers in traditional pensions, the portion of employees participating in a retirement plan dropped in 2006, the Employee Benefit Research Institute said Thursday.

The decline was steepest -- a drop of 2 percentage points -- among the full-time, full-year workers who are considered most strongly connected to the work force and likeliest to participate in an employer-sponsored retirement plan, according to the report.

...

Looking at all workers, including part-timers, the percentage participating in an employment-based retirement plan decreased to about 40% in 2006, from 41% in 2005, but that drop was largely fueled by the decrease among the full-time group. In 2000, the level topped 44% of all workers, a recent high. ...

Thursday, November 1, 2007

Homes targeted by some sort of foreclosure activity from July to September, up 100.1 percent from a year-ago ...

...

A total of 446,726 homes nationwide were targeted by some sort of foreclosure activity from July to September, up 100.1 percent from 223,233 properties in the year-ago period, according to Irvine-based RealtyTrac Inc.

The current figure was 33.9 percent higher than the 333,731 properties in foreclosure in the second quarter of this year. ...