Monday, March 24, 2008

"workers and households pay for health insurance through lower wages and higher prices,"

...

The main reason: spiraling health-care costs have been whacking away at their wages. Even though workers are producing more, inflation-adjusted median family income has dipped 2.6 percent -- or nearly $1,000 annually since 2000.

Employees and employers are getting squeezed by the price of health care. The struggle to control health costs is viewed as crucial to improving wages and living standards for working Americans. Employers are paying more for health care and other benefits, leaving less money for pay increases. Benefits now devour 30.2 percent of employers' compensation costs, with the remaining money going to wages, the Labor Department reported this month. That is up from 27.4 percent in 2000.

"The way health-care costs have soared is unbelievable," said Katherine Taylor, a vice president for Local 1199 of the Service Employees International Union. "There are people out here making decisions about whether to keep their lights on or buy a prescription."

Since 2001, premiums for family health coverage have increased 78 percent, according to a 2007 report by the Kaiser Family Foundation. Premiums averaged $12,106, of which workers paid $3,281, according to the report.

...

Researchers Ezekiel J. Emanuel and Victor R. Fuchs say that employer-sponsored health-care plans create the "myth" that workers are getting their health benefits for little or nothing. But, in fact, "workers and households pay for health insurance through lower wages and higher prices," they wrote in the March 5 issue of the Journal of the American Medical Association. ...

food, energy and medical care [take] a bigger chunk than since records began in 1960

...

Signs of the pinch are showing up everywhere:

-By the end of 2007, 36 percent of consumers' disposable income went to food, energy and medical care, a bigger chunk of income than at any time since records were first kept in 1960, according to Merrill Lynch.

...

Nearly 9 million households now have upside-down mortgages, and for the first time ever, aggregate mortgage debt is bigger than the total value of homeowner equity - bigger by $836 billion, according to research by Merrill Lynch. ...

Wednesday, March 19, 2008

Derivatives the new 'ticking bomb' ... Warren Buffet in 2002 !

ARROYO GRANDE, Calif. (MarketWatch) -- "Charlie and I believe Berkshire should be a fortress of financial strength" wrote Warren Buffett. That was five years before the subprime-credit meltdown.

"We try to be alert to any sort of mega-catastrophe risk, and that posture may make us unduly appreciative about the burgeoning quantities of long-term derivatives contracts and the massive amount of uncollateralized receivables that are growing alongside. In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal."

That warning was in Buffett's 2002 letter to Berkshire shareholders. He saw a future that many others chose to ignore. The Iraq war build-up was at a fever-pitch. The imagery of WMDs and a mushroom cloud fresh in his mind.

...

- Sarbanes-Oxley increased corporate disclosures and government oversight

- Federal Reserve's cheap money policies created the subprime-housing boom

- War budgets burdened the U.S. Treasury and future entitlements programs

- Trade deficits with China and others destroyed the value of the U.S. dollar

- Oil and commodity rich nations demanding equity payments rather than debt

...

This cascading "domino effect" was brilliantly described in "The $300 Trillion Time Bomb: If Buffett can't figure out derivatives, can anybody?" published early last year in Portfolio magazine, a couple months before the subprime meltdown. Columnist Jesse Eisinger's $300 trillion figure came from an earlier study of the derivatives market as it was growing from $100 trillion to $516 trillion over five years. Eisinger concluded:

...

Tuesday, March 18, 2008

crisis will only end when house prices stop falling: require the US government to intervene directly in the real estate market

... That pretence was stripped away when JP Morgan, at the behest of the Federal Reserve, stepped in when the hedge funds pulled the plug on the fifth-biggest US investment bank.

It is now clear that no end is in sight to the turmoil, and the reason for that is that the Fed and the US treasury are no closer to solving the underlying problem than they were eight months ago. The crisis will only end when house prices stop falling and banks stop racking up huge losses on their loans. Doing that, however, will require the US government to intervene directly in the real estate market to end the wave of foreclosures. Ideologically, it is ill-equipped to take that step and, as a result, property prices will fall and the financial meltdown will go on and on.

Ultimately, though, action will be taken because there will be political pressure for it. Indeed, it is somewhat surprising that there is not already rioting in the streets, given the gigantic fraud perpetrated by the financial elite at the expense of ordinary Americans.

The US has just had its weakest period of expansion since the 1950s. Consumption growth has been poor. Investment growth has been modest. Exports have been sluggish. But if you are at the top of the tree, the years since the last recession in 2001 has been a veritable golden age. Salaries for executives have rocketed and profits have soared, because the productivity gains from a growing economy have been disproportionately skewed towards capital.

...

... The method chosen was simple. Whip up a colossal housing bubble, convince consumers that it makes sense to borrow money against the rising value of their homes to supplement their meagre real wage growth and watch the profits roll in.

As they did - for a while. Now it's payback time and the mood could get very ugly. Americans, to put it bluntly, have been conned. They have been duped by a bunch of serpent-tongued hucksters who packed up the wagon and made it across the county line before a lynch mob could be formed.

...

In the longer term, lessons must be learnt from the turmoil. One is that you don't solve the problems of a collapsing bubble by blowing up another, which is what Alan Greenspan did after the dotcom fiasco in 2001 - the most irresponsible behaviour of any central banker in living memory.

The second lesson is that there has to be far stricter regulation not just of the US real estate market but of Wall Street, to prevent the return of irresponsible lending as soon as the recovery is firmly under way. If this is, heaven help us, The Big One, one of the only consolations will be that the repugnance at the orgy of speculation that has sapped the strength of the US economy will put a new New Deal on the political agenda.

But for this to happen there has to be a political response and even though this year's presidential election will be held in the shadow of recession, there appears not to be a potential FDR among the contenders for the White House. Yet if this crisis really does get as bad as some are forecasting, the public will rightly demand more than a slap on the wrist for Wall Street.

Reagan / Republican economist: Feldstein said the downturn could be the worst in the United States since World War Two

BOCA RATON, Florida (Reuters) - The United States is in a recession that could be "substantially more severe" than recent ones, National Bureau of Economic Research President Martin Feldstein said on Friday.

"The situation is very bad, the situation is getting worse, and the risks are that it could get very bad," Feldstein said in a speech at the Futures Industry Association meeting in Boca Raton, Florida.

"There's no doubt that this year and next year are going to be very difficult years."

NBER is a private sector group that is considered the arbiter of U.S. business cycles. Feldstein is also a Harvard economics professor and former economic advisor to President Ronald Reagan.

Answering questions from the audience, Feldstein said the downturn could be the worst in the United States since World War Two. ...

Herbert 1930s Hoover said this to Congress:Economic depression cannot be cured by legislative action or executive pronouncement ...

As the economy spirals downward into what many economists view is already a recession, President Bush delivered a speech this week expressing confidence “in the ability of the markets” to turn it around.

In 1930, as the U.S economy was sinking into deep recession, President Herbert Hoover said this to Congress:

Economic depression cannot be cured by legislative action or executive pronouncement. Economic wounds must be healed by the action of the cells of the economic body - the producers and consumers themselves.

In his speech this week, Bush echoed Hoover: “The temptation of Washington is to say that anything short of a massive government intervention in the housing market amounts to inaction. I strongly disagree with that sentiment. … Government actions are — have far-reaching and unintended consequences.”

The unfortunate similarities in these statements and attitudes led Sen. Chuck Schumer (D-NY) to offer this observation on Fox News this morning:

Schumer added that this has become “the Bush recession,” while Sen. Chris Dodd (D-CT) noted that this will be the second recession in this administration. ...The President is indeed behaving like Herbert Hoover. We’re in the most serious economic problem we’ve been in in a very long time — much worse than 2001. The President’s hands-off attitude is reminiscent of Herbert Hoover in 1929 and 1930.

regulation of corporate financial behavior is domestic equivalent of Islamofascism: catastrophic failure of intelligence about Wall Street rapacity

If George W. Bush had read The Pet Goat to his Economic Club of New York audience on Friday, his speech would have been no less infantile. If the first 9/11 was caused by a massive failure of intelligence about terrorism, the second 9/11 -- the slow-motion collapse of the American, and maybe the global, economy -- has been caused by a catastrophic failure of intelligence about Wall Street rapacity. If the now five-year-old Iraq war was the inevitable, tragic consequence of the neoconservatives' Project for the New American Century, then the subprime mortgage quagmire, the Bear Stearns bailout, and the foreclosure fiasco are the foreordained outcome of the Republican ideology which holds that regulation of corporate financial behavior is the domestic equivalent of Islamofascism.

The economic meltdown is the new 9/11, and it's George W. Bush's fault -- his, and the fundamentalist free-marketeers who have been living high on the hog, feeding at the public trough, intimidating Democrats, and getting away with capitalist murder ever since Ronald Reagan made "government" a dirty word. ...

...

Toxic dumps are required to have warning signs on them. It would be fitting if schoolchildren saw a mandatory DANGER: MORAL HAZARD notice when, on a day that can't come too soon, they enter the George W. Bush Presidential Library.

Monday, March 17, 2008

Wall Street fears for next Great Depression

Wall Street is bracing itself for another week of roller-coaster trading after more than $300bn (£150bn) was wiped off the US equity markets on Friday following the emergency funding package put together by the Federal Reserve and JPMorgan Chase to rescue Bear Stearns.

One UK economist warned that the world is now close to a 1930s-like Great Depression, while New York traders said they had never experienced such fear. The Fed's emergency funding procedure was first used in the Depression and has rarely been used since. ...

Saturday, March 15, 2008

financial system that largely marginalized traditional banking and that enabled lenders to evade much of the regulatory framework from the 1930s

It was an old-fashioned bank run that forced Bear Stearns to turn to the government for salvation on Friday. The difference is that Bear Stearns is not a commercial bank, and is therefore not eligible for the protections those banks received 75 years ago when Franklin D. Roosevelt halted bank runs with government guarantees.

Bear was, instead, emblematic of a financial system that grew up over the last two decades, one that largely marginalized traditional banking and that enabled lenders to evade much of the regulatory framework that had also begun during the Roosevelt administration.

The new system enabled loans to be made by almost any financial institution with the money coming from the sale of increasingly complicated securities backed by the loans.

Regulators believed that the new system spread out the risk. Alan Greenspan, a former chairman of the Federal Reserve, said the system had transferred risk from banks — which he called “highly leveraged institutions” — to “stable American and international institutions.”

It turned out he was wrong. Much of the risk had remained with commercial banks, but packaged in such a way that they were required to put aside fewer reserves to protect against losses. Much of the rest of the risk ended up with financial institutions that relied on their ability to borrow at low rates whenever they needed it.

staggering $7.7 trillion. This number represents the fiscal harm that President Bush has inflected on our nation. This number is the Bush debt

Today, lawmakers took to the Senate floor and blasted President Bush’s wasteful spending. To fully illustrate the impact, Sen. Sheldon Whitehouse (D-RI), brought up a chart showing the budget plans of President Clinton versus the budget formulated by Bush. He concluded that by squandering Clinton’s government surplus, Bush has cost the country $7.7 trillion:

This next chart illustrates the value of the differences between the budget landscape planned by President Clinton and the one created by President Bush. As you can see, the difference between the two is a staggering $7.7 trillion. This number represents the fiscal harm that President Bush has inflected on our nation. This number is the Bush debt. […]

Like most concepts of enormous size, this amount takes some thought to comprehend. $7.7 trillion is $25,000 owed by every adult or child in the United States.

Watch it: ...

H-Ib visa bill: "would do serious damage to the American information technology labor market, displacing many American workers ... speed up offshoring

A bill introduced in the U.S. Congress would double the number of immigrant worker visas available each year under the H-1B program.

Microsoft today praised a bill introduced in the U.S. Congress that would double the number of immigrant worker visas available each year under the H-1B program.

...

The bill would prohibit companies from hiring H-1B workers, then outsourcing them to other companies, he said. H-1B opponents have complained that outsourcing companies are among the top users of H-1B visas. [~80% go to Indian companies, outsourcers. ed.]

The legislation would also prohibit companies with more than 50 employees that have more than half of their staff as H-1B workers from hiring more H-1Bs, and it would prohibit employers from advertising jobs as available only to H-1B workers [i.e. ban-US worker discrimination. ed.], Karamargin said. "The bill would put some teeth in the Department of Labor's oversight role" of the program, he said.

...

But despite some attempts at addressing H-1B fraud, Giffords' bill would do little to address worker concerns about the program, said Ron Hira, a public policy professor at the Rochester Institute of Technology and former chairman of the Career and Workforce Policy Committee at the Institute of Electrical and Electronics Engineers-USA.

"This bill takes none of the concerns raised by American technology workers seriously," Hira said. He called the bill a "massive" increase in the H-1B cap.

"This bill will basically do nothing to stem employers from using the H-1B program as a source of cheap labor and to substitute for American workers," Hira said. "It doesn't require any kind of labor market test -- demonstrating that a shortage actually exists before hiring an H-1B."

The bill doesn't fix "serious problems" in setting wage floors for H-1B workers, Hira added. "No matter how one dresses up this bill, it would do nothing to curb the practice of companies bringing in computer programmers for $12 per hour to displace U.S. workers," he said. "If this bill were to be passed as written, it would do serious damage to the American information technology labor market, displacing many American workers, discouraging the next generation of students from entering the career, and speed up the offshoring of high-wage high-technology jobs."

Friday, March 14, 2008

Payday loans: typical borrower pays back $793 on a $325 loan ... interest can top 500 percent in annual terms

New Hampshire's payday lenders will likely close shop next winter. The Senate yesterday approved a tight cap on payday and title loans, a measure that supporters and detractors agree would put the industry out of business.

Gov. John Lynch will sign the bill, which has already cleared the House, a spokesman said.

The bill's supporters say that payday lenders target vulnerable people and make it difficult for them to climb out of debt because the interest rates are so high that borrowers have to take out a second loan to pay off the first one. The measure would cap interest rates on the small loans - which now top 500 percent in annual terms - at 36 percent a year. At those rates, Advance America, which has 21 locations in New Hampshire, would lose $100,000 per storefront, spokesman Jamie Fulmer said.

"It would mean we would have to close our centers," Fulmer said, adding that 200 people work in the industry statewide. "We're just extremely disappointed about today's vote and certainly are very concerned about the 200 New Hampshire residents whose jobs are at risk now."

Payday loans are weeks-long loans of $300 to $500, secured with a pay stub and paid back with a flat fee that translates to an annual interest rate in the hundreds. Title loans require the borrower's car as collateral. Sen. David Gottesman, a Nashua Democrat who supported the bill, said that a typical borrower pays back $793 on a $325 loan, "after getting mired in five or more loan transactions."

"The evidence shows that those most likely to get caught in the debt trap are those living on fixed incomes and vulnerable families feeling the national economic squeeze," Gottesman said. "The money that feeds the payday loan industry and their investors is money that could be going to pay for medicines and food and mortgage payments here in New Hampshire." ...

NY governor warns of 'financial tsunami'

WASHINGTON (AFP) - New York state governor Eliot Spitzer warned Thursday that bond and credit woes afflicting Wall Street and global markets could turn into a more damaging "financial tsunami."

In testimony to the US Congress, Spitzer urged lawmakers and regulators to urgently address the bond and credit problems roiling the financial industry which have forced some big firms to writeoff billions of dollars in troubled securities.

"If we do not take effective action, this could be a financial tsunami that causes substantial damage throughout our economy," Spitzer said, according to a transcript.

He said the financial difficulties of bond insurance companies could have a widespread effect because they insure a broad range of bonds and securities such as municipal bonds, college loans and even relate to museum budgets. ...

Bush tax cuts: debt-to-GDP will rise inexorably starting after 2010, reaching 100 percent in 2035 and more than 200 percent in 2050

...

All else being equal, if the tax cuts are made permanent — without making up for the lost revenue by raising other taxes or cutting spending — debt-to-GDP will rise inexorably starting after 2010, reaching 100 percent in 2035 and more than 200 percent in 2050. Courting debt loads of that magnitude implies severe economic distress.

In contrast, if the tax cuts are allowed to expire, debt-to-GDP will dip a bit in the decades to come and then rise rapidly, to 100 percent by 2050, pushed up mainly by rising health care costs. That’s still a big problem, but not nearly as big as it will be if the tax cuts are also extended. ...

Some major banks are doubling their rates for credit cards to nearly 30 percent — even for good customers ...

The Federal Reserve keeps trimming interest rates. But credit card costs are soaring.

Some major banks are doubling their rates for credit cards to nearly 30 percent — even for good customers. ...

Ohio experiences largest proportionate decline in employment since the end of the Great Depression

The more than 209,000 non-farm jobs Ohio lost from 2000 to 2007 comprised the largest proportionate decline in employment since the end of the Great Depression, a national manufacturing trade group said Wednesday.

Employment dropped by 3.7 percent, the biggest seven-year drop since the period starting in 1939, near the end of the Depression and including the years the U.S. military absorbed millions of American workers to fight World War II...

McMillion, also in Washington, said Ohio lost 23.3 percent of its manufacturing sector jobs, or 236,000 positions, over the recent seven years. Some other sectors gained jobs. It was a period, he said, of markedly lower capital investment in domestic industrial capacity in Ohio and throughout the nation.

It was also a period, he said, when American consumers and the government borrowed $10.3 trillion, "what should have been a tremendous stimulus," but it scarcely helped American workers. ...

"financial weapons of mass destruction.": With 10,000 disparate mortgages underlying the paper, cash payments and risk impossible to predict

It doesn't look like an old-fashioned bank run because it involves the biggest financial institutions trading paper assets so complicated that even top executives don't fully understand the transactions. But that's what it is -- a spreading fear among financial institutions that their brethren can't be trusted to honor their obligations.

...

... The problem, he said, is that financial institutions are required to "mark to market" their tradable assets (which is a fancy term for setting a value) even when there isn't a functioning market. In many cases dealers can do little more than guess at the value -- and other investors down the line know it.

To explain how this happened, the CFO took a simple example of residential mortgages. As financial engineering improved in the 1990s, these individual loans were gathered into bundles -- 10,000 home loans of $100,000 each, let's say -- and turned into a $1 billion security that could be traded in ways the individual mortgages never could. But that wasn't enough. The financiers realized they could boost their profits by carving the $1 billion package into different slices, with different risk levels. In that way, a pool of B-rated mortgage assets could generate a slice that was rated AAA, because it was judged the slice most likely to be repaid.

But what happened when the real estate market confounded recent history and began to turn down? People holding the paper could no longer be sure if or when their particular slice would be repaid. The traditional accounting approach -- of estimating the projected cash flow and then discounting for the risk -- didn't work. With 10,000 disparate mortgages underlying the paper, both the rate of cash payments and the risk of default were impossible to predict. So the pyramid began to wobble.

The hubris in this system was Wall Street's confidence that it could value paper securities that had been sliced and diced so many times that they no longer had solid connections to their underlying assets. The nation's leading financier, Warren Buffett, had warned years before that "derivatives," whose value was balanced loosely on the real assets underneath, were the equivalent of "financial weapons of mass destruction." But in the rush for profits, nobody listened.

I've saved the worst for last. Do you want to know who is bailing out America's biggest banks and financial institutions from the consequences of their folly -- by acting as the lender of last resort and controller of the system? Why, it's the sovereign wealth funds, owned by such nations as China and the Persian Gulf oil producers. The new titans are coming to the rescue, if that's the right word for their mortgage on America's future.

Iraq war 'caused slowdown in the US' ... cost approaches $3Trillion ... 25% of GDP

THE Iraq war has cost the US 50-60 times more than the Bush administration predicted and was a central cause of the sub-prime banking crisis threatening the world economy, according to Nobel Prize-winning economist Joseph Stiglitz.

The former World Bank vice-president yesterday said the war had, so far, cost the US something like $US3trillion ($3.3 trillion) compared with the $US50-$US60-billion predicted in 2003.

...

The money being spent on the war each week would be enough to wipe out illiteracy around the world, he said.

Just a few days' funding would be enough to provide health insurance for US children who were not covered, he said.

...

One of the greatest discrepancies is that the official figures do not include the long-term healthcare and social benefits for injured servicemen, who are surviving previously fatal attacks because of improved body armour.

"The ratio of injuries to fatalities in a normal war is 2:1. In this war they admitted to 7:1 but a true number is (something) like 15:1."

Some 100,000 servicemen have been diagnosed with serious psychological problems and the soldiers doing the most tours of duty have not yet returned. ...

America is turning into "a giant hedge fund." ... as financial services take 40% of all profits

...

The hard reality is that the economy is facing a one-two knockout blow from a collapse in consumer spending, plus a shock-and-awe wave of asset write-downs that is wreaking havoc in the financial sector. The more Bernanke floods the economy with easy money, the worse the final reckoning is likely to be.

First the consumer. For decades, personal consumption’s share of GDP averaged in the 66 percent-67 percent range. In 2000, however, it moved up sharply, hitting 72 percent in early 2007, the highest rate of consumption in any modern country ever.

How did consumers pay for it? Well, not with their wage packet—median household incomes were roughly flat in the 2000s. Instead, households doubled their debt load, and personal savings rates dropped to zero.

...

... The same problems infect almost every important asset class. Commercial mortgages had a drunken spree of their own in 2006 and 2007. A sign of the times: the big New York developer, Harry Macklowe, is unable to pay $7 billion in debt on seven prime Manhattan office buildings he bought less than a year ago. The takeover loans that fueled the 2006-2007 stock market boom are also faltering badly. Trading markets are now pricing prime takeover loans and commercial mortgages as if they were junk bonds.

On quite reasonable assumptions, total market losses from defaults and writedowns on mortgages of all kinds, and from junk bonds, leveraged takeover loans, credit cards, and auto loans, will be in the range of $1 trillion. ...

==================================

Imploding Credit Bubble to Hit $1 Trillion | Money Was Free For Banks Under Greenspan, Creating a Debt-Driven Economy | By Charles R. Morris 02/12/2008 | 4 Comments

The current credit and financial crisis, unusually, is almost entirely the creation of the financial services industry.

Financial services now dominates American business to an astonishing degree. Though the industry accounted for only about 16 percent of corporate output in 2007, it racked up more than 40 percent of corporate profits. From 2000 through mid-2007, total American stock market value grew about 6 percent, while the value of financial services stocks grew by 78 percent. And though total corporate profits roughly doubled, business investment was almost flat.

Where did the profits go? Mostly to dividends and stock buybacks, much of which, in turn, poured into the hedge funds and private equity funds driving the company buyout boom. Martin Wolf, an economist and columnist for the London Financial Times, laments that America is turning into "a giant hedge fund." ...

...

The scale of the required writedowns is scary. Bank capital will be decimated, necessitating perhaps $150-$200 billion in new capital raising. The tens of billions in new capital raised by banks last year almost all came from sovereign wealth funds – murky investment vehicles mostly under the control of Asian and Arab governments. It is not xenophobic to worry about the sale of yet another huge block of ownership to such entities. ...

Fed's Rate Cuts Bring No Relief For Consumers' Credit Card Bills

The Federal Reserve's dramatic rate cuts were expected to make it cheaper for consumers to use credit cards. But credit card interest rates remain high and in many cases have even climbed.

Bruised by a rise in foreclosures, banks have been reluctant to lower rates for cardholders who have missed payments or had their credit scores slip, analysts and industry watchdogs said. Yet even some cardholders who pay on time have not benefited from the Federal Reserve's recent actions, as banks raise rates and fees to make up for losses in their mortgage departments, analysts said. ...

Merrill Lynch report, home prices will drop 15 percent this year

NEW YORK (CNNMoney.com) -- The worst housing financial crisis in decades is only going to get worse, a Merrill Lynch report said Wednesday.

The investment bank forecasted a 15 percent drop in housing prices in 2008 and a further 10 percent drop in 2009, with even more depreciation likely in 2010.

By contrast, the National Association of Realtors (NAR) expects housing prices to remain flat in 2008. NAR did cut its home price estimate for the current quarter, however, to a 5.3 percent year-over-year decline, which represents the steepest drop in that price measure on record. But NAR sees an uptick in home prices in the last two quarters of 2008. ..

Wal-Mart says its shoppers are redeeming their holiday gift cards for basic items — pasta sauce, diapers

Here is a sign of how shaky the economy is becoming: Wal-Mart says its shoppers are redeeming their holiday gift cards for basic items — pasta sauce, diapers, laundry detergent — rather than iPods and DVDs. ...

Buffett on financial crisis: "people that brewed this toxic Kool-Aid found themselves drinking a lot of it"

...

Mr. Buffett, the head of Berkshire Hathaway and one of the world’s wealthiest people, appeared to see irony in the fallout hitting many of the banks who marketed complex investments that have now crashed.

“It’s sort of a little poetic justice, in that the people that brewed this toxic Kool-Aid found themselves drinking a lot of it in the end,” Mr. Buffett said during a question and answer session at a business event in Toronto.

real wages actually fell last year ... productivity growth to "managerial . . . innovations" ... unpaid ovetime, less breaks ...

...

The economy, for example, has been expanding, at least until now, and growth is supposed to guarantee general well-being. As long as the gross domestic product grows, World Money Watch's Web site assures us, "so will business, jobs and personal income."

But hellooo, we've had brisk growth for the past few years, as the president has tirelessly reminded us, only without those promised increases in personal income, at least not for the poor and the middle class. According to a study just released by the Economic Policy Institute, real wages actually fell last year. Growth, some of the economists are conceding in perplexity, has been "decoupled" from widely shared prosperity.

...

We like to attribute our high productivity to technological advances and better education. But a revealing 2001 study by the consulting firm McKinsey & Co. also credited America's productivity growth to "managerial . . . innovations" and cited Wal-Mart as a model performer, meaning that our productivity also relies on fiendish schemes to extract more work for less pay. Yes, you can generate more output per apparent hour of work by falsifying time records, speeding up assembly lines, doubling workloads and cutting back on breaks. That may look good from the top, but at the middle and the bottom, it can feel a lot like pain.

...

Consider how we got into the current credit crisis in the first place, through defaults on subprime mortgages. These went to plenty of affluent folks and have wreaked havoc in gated communities. But overall, subprime loans were designed for, and snapped up by, the poor. According to a recent study from United for a Fair Economy, 55 percent of subprime loans went to African Americans and 17 percent to whites. Among whites, they went far more frequently to low-income people than to the wealthy -- 39 percent compared with 24 percent. Hence the subprime industry's noble boasts about providing the opportunity for home ownership to people who might otherwise have been excluded from it.

...

Not that we hadn't been warned. A century ago, Henry Ford realized that his company would only prosper if his own workers earned enough to buy Fords. But, like Wal-Mart, too many of our employers today haven't figured out that their cruelly low wages would eventually curtail their own growth and profits. ...

"5% unemployment today is worse than 5% unemployment 10-15 years ago,"

An unemployment rate of 5% is low by historic standards. But the number of people out of work for long stretches is rising dramatically.

...

But the jobs numbers may be even worse than they first appear. That's because the number of Americans who have been out of work for six months or longer is on the rise.

Harder to find a new job The number of long-term unemployed stood at a seasonally-adjusted 1.3 million in December, up about 22 percent from year-earlier levels. The full-year average for 2007 was 1.2 million long-term unemployed, nearly double the reading for 2000 -- just before the last recession.

For all of 2007, about 17.6% of those who were unemployed had been out of work six months or more. That compares to only 11.4% who were long-term unemployed in 2000.

"You have to understand that 5% unemployment today is worse than 5% unemployment 10-15 years ago," said Jason Furman, senior fellow, Brookings Institution. ...

Inflation: America 's Greatest Export

Unfortunately one of the few things still made in America is inflation. In fact, it now ranks as our greatest export.

A significant by-product of the current global economic system, wherein Americans spend money they do not earn to buy foreign products that they do not make, is that trillions of dollars are now parked in foreign banks just looking for somewhere to go.

...

In years past, foreign investors were happy to hold strong U.S. dollars, which they either saved as a store of value, or used to purchase mighty Wall Street stocks and bonds. However, when the dollar began its epic swan dive, and U.S. investments began to grossly underperform non-U.S. alternatives, private investors dumped their dollars en masse by exchanging them for local currencies. The unwanted dollars then became the property and problem of foreign central banks.

If central banks did not buy these dollars, foreign citizens would have been forced to sell their surplus dollars on the open market. To prevent this from happening these banks have become the buyers of first and last resort. However, to sop up all of the excess supply, central banks must create more of their own, resulting in rapidly expanding money supplies. As much as Wall Street and government economists pretend otherwise, the expansion of money supply is the essential definition of inflation. The real reason that prices are rising in China is that so many yuan are being printed to buy up all these surplus dollars. ...

Countrywide: Overdue loans rose to 7.47 percent ... up from 4.32 in one year

Feb. 15 (Bloomberg) -- Countrywide Financial Corp., the biggest U.S. mortgage lender, said late loans were at their highest level in at least six years during January, adding to evidence that the U.S. housing slump is getting deeper.

Overdue loans rose to 7.47 percent of unpaid principal balances from 7.2 percent in December and 4.32 percent in January 2007, according to a Countrywide statement today. Foreclosures advanced to 1.48 percent in January, also a six- year high, from 1.44 percent in December and 0.77 percent a year earlier. ...

U.S. Mortgage Foreclosures Rise as Owners `Give Up' (Update3) ... up 60%+

March 6 (Bloomberg) -- U.S. mortgage foreclosures rose to an all-time high at the end of 2007 as borrowers with adjustable-rate loans walked away from properties before their payments increased, the Mortgage Bankers Association said today.

New foreclosures jumped to 0.83 percent of all home loans in the fourth quarter from 0.54 percent a year earlier. Late payments rose to a 23-year high, the organization said in a report today.

``We're seeing people give up even before they get to the reset because they couldn't afford the home in the first place,'' said Jay Brinkmann, vice president of research and economics for the Washington-based trade group. ...

PEC blames 'mismanaged' U.S. economy for soaring oil prices

OPEC, rebuffing calls from U.S. President George W. Bush to increase oil output, cited "mismanagement" of the American economy as a major factor driving prices up.

...

The cartel's president on Wednesday blamed financial speculators and American economic problems, which have helped lower the value of the dollar, for the high oil prices. After the meeting, oil prices settled above $104 a barrel, a record.

...

Oil prices settled at a record of $104.52 a barrel on the New York Mercantile Exchange, a gain of $5. Prices, which have risen 73 percent this year, have settled above the $100-per-barrel mark for seven of the past 12 trading sessions.

...

The dollar has lost 17 percent of its value against the euro this year. On Wednesday, it fell to a new low against the euro, trading at $1.53.

"OPEC is angry that President Bush wants them to increase production while the dollar is sinking and the administration is doing nothing about that," said Fadel Gheit, an oil analyst at Oppenheimer. in New York. "It's really not surprising that they have ignored him."

...

"If the prices are high, definitely they are not due to a lack of crude," Khelil said in Vienna. "They are due to what's happening in the U.S."

He added: "There is sufficient supply. There's plenty of oil there."

Most energy analysts agree there is no shortage of oil. Commercial oil inventories are high, and refiners are not lacking oil.

"The market continues to be well supplied," Rex Tillerson, the chairman and chief executive of Exxon Mobil, said at a conference in New York. "There has been no interruption of supplies." ...

Thursday, March 13, 2008

Republicans and "Free Market" Zealots Bring Disaster to America

March 12. Crude oil for April delivery hit $110 per barrel. The US dollar fell to a new low against the Euro. It now takes $1.55 to purchase one Euro.

These new highs against the dollar are the ongoing story of the collapse of the US dollar as world reserve currency and corresponding collapse of American power.

Each new decision from the insane Bush regime pushes the dollar a little further along to oblivion. ...

...

More pressure on the dollar resulted from the decision to award the European company, Airbus, a $40 billion contract that could reach $100 billion to build US Air Force tankers. In simple terms, that means another $40 to $100 billion added to the US trade deficit, and a loss of $40 to $100 billion in US Gross Domestic Product and associated jobs.

Of course, the Bush regime had to award the contract to Europe as a payoff for Europe’s support of the Bush regime’s wars of aggression in the Middle East. Europe is not going to provide Bush with diplomatic cover for his wars and NATO troops for his war in Afghanistan without a payoff.

...

The US is dependent on foreigners not only for energy but also for manufactured goods and advanced technology products. The US is dependent on foreigners to finance our consumption of $800 billion annually more than the US produces. The US is dependent on foreigners to finance its red ink wars, and the US government’s budget deficit is now expanding as tax revenues decline with the declining economy.

The bottom line: US power is enfeebled. US power depends on the willingness of foreigners to finance our wars and on the willingness of foreigners to continue to accumulate depreciating dollar assets.

The US cannot close its trade deficit. Oil prices are rising, and offshore production of goods and services for US markets results in a dollar-for-dollar increase in imports, while reducing the supply of domestic goods available for export.

The US cannot close its budget deficit while it is squandering vast sums on wars that serve no US purpose, handing out $150 billion in red ink rebates, and falling into recession.

US living standards, which have been stagnant for years, will plummet once dollar decline forces China off the dollar peg. So far prices of the Chinese-made goods on Wal-Mart shelves have not risen, because the Chinese currency, pegged to the dollar, falls in value with the dollar. In a word, tottering US living standards are being supported by China’s willingness to subsidize US consumption by keeping its currency grossly undervalued.

The US is overextended economically and militarily, just as was Great Britain with the fall of France in the opening days of World War II. The British had the Americans to bail them out. After the chewing gum and bailing wire patch-ups are exhausted, who is going to bail us out?

Carlyle Capital Nears Collapse: For every dollar of equity, the pool borrowed $32 [OVERLEVERAGED, UNREGULATED, Ed]

March 13 (Bloomberg) -- Carlyle Group said creditors plan to seize the assets of its mortgage-bond fund after it failed to meet more than $400 million of margin calls on mortgage- backed collateral that plunged in value.

Carlyle Capital Corp., which began to buckle a week ago from the strain of shrinking home-loan assets, said in a statement it defaulted on about $16.6 billion of debt as of yesterday. The dollar fell to a 12-year low against the yen and European stocks tumbled.

...

The fund's losses were caused by ``excessive leverage,'' said Arthur Levitt, a senior Carlyle adviser, in a Bloomberg Radio interview today. ``This did not affect the overall Carlyle enterprise,'' said Levitt, former chairman of the Securities and Exchange Commission and a board member of Bloomberg LP, the parent of Bloomberg News.

...

Carlyle Capital originally delayed and then cut the size of its IPO by about 25 percent as the subprime contagion began. In all, the fund used about $670 million of equity to amass a $22 billion portfolio of mortgage debt. For every dollar of equity, the pool borrowed $32. ...

More Americans borrowing from 401(k) to pay bills

Trent Charlton knew the risks when he borrowed $10,000 from his 401(k) and cut his retirement savings in half.

But Charlton, a 40-year-old account executive at an Irvine trucking company, said he had little choice because he and his wife could not keep up with monthly expenses after American Express reduced the limits on three credit cards.

As home prices fall and banks tighten lending standards, more people are doing the same thing: raiding their retirement savings just to get by and spending their nest eggs to gas up SUVs, pay mortgages or put food on the table. ...

The Fed's in a desperate race with spectre of collapse ... not seen anything like it since the decade of the Great Depression

Equity traders, being ever the optimists, decided to look on the bright side of yesterday's central bank intervention. London and New York did a jig after the US Federal Reserve and Bank of England pulled out all the stops to avoid markets falling into a pit of despair.

And who can blame them? When you've got state institutions as big as the Fed supporting markets then where's the worry?

The Fed, with its latest $200bn offer of cheap cash, has provided yet more state aid for errant hedge funds and another Washington-backed bail-out for Wall Street bankers. The Bank of England joined in again, further shedding any notion of being wary of moral hazard. But as the bail-outs are getting bigger, then clearly the problems causing them must be getting bigger.

The Fed has saved the day again, but it will only be for a day or so. It was Friday remember when it had to pump $200bn of cash into the system. Yesterday it was offering to lend a similar amount to try and soak up some of the toxic debt out there which has left the lending markets hamstrung. How much further can the central banks go to support a system that is so obviously broken?

Arguably, having come this far, Mervyn King and Ben Bernanke have breached the point of no return. There is no going back. The US certainly is now relying on its central bank to keep its most important credit markets open, its equity markets from plunging and bring a veneer of normality to financial life. Traditional supports, such as confidence in normal commercial debt repayment, have been knocked away as institutions are engaged in a desperate dash for cash.

We have not seen anything like it since the decade of the Great Depression. Melodramatic as that might sound, it is a fact but a fact that markets seem unwilling to accept. ...predictable outcome of a system that rewarded smart people small fortunes for conjuring up ways to persuade people to borrow more than they could pay

WASHINGTON (MarketWatch) -- You know things are very very bad on Wall Street when a guy like Henry Paulson -- Treasury secretary, solid Republican, and former Goldman Sachs CEO -- joins the crowd calling for more regulation over the financial markets.

Wall Street and Washington both failed big time, he said. Wall Street invented new ways to make money by selling securities so complicated that no one could really follow which shell the pea was under. Fortunes were made on the paper Wall Street sold.

At the same time, Washington's watchdogs were dozing, tranquilized by the false assurance that Wall Street would police its own.

It's been obvious for years now that Wall Street could not be trusted, and finally official Washington agrees. The markets need a tougher cop to make sure that money-center banks, investment banks, credit-rating agencies, hedge funds, mortgage brokers and the rest don't let their own greed and arrogance ruin it for the rest of us.

"Regulation needs to catch up with innovation," Paulson said, and he was backed up by the rest of President Bush's working group on financial markets, including Federal Reserve Chairman Ben Bernanke and Securities and Exchange Commissioner Chris Cox. Not a commie among them.

Paulson's proposals won't necessarily prevent a recurrence, but they are a humble recognition that the centerpiece of two decades of Republican economic policy have failed.

Thursday, March 6, 2008

40 percent of creditors foreclosing on borrowers did not show proof of ownership

...

The Wellmans may lose their home even though their accountant testified to the court in 2006 that the lender had levied improper charges on the borrower of about $40,000, or almost 13 percent of what the bank said the Wellmans owed at the time.

Every home foreclosure is different, of course. But the Wellmans’ case shows the uphill battle facing many troubled borrowers who believe that they are losing their homes for questionable reasons, like onerous fees.

One problem is ascertaining who actually owns the note underlying each home loan. This seemingly simple task has turned difficult as more home mortgages have been packaged by the thousands into securitization trusts.

Katherine M. Porter, an associate professor of law at the University of Iowa, conducted a recent study of 1,733 foreclosures that began in 2006. The study found that 40 percent of creditors foreclosing on borrowers did not show proof of ownership, what is often called “proper assignment” of the note or security interest in the property.

Dubious fees charged by lenders have also emerged as a rising problem. Ms. Porter’s study found that questionable fees had been added to almost half of the loans she examined. Last year, the United States Trustee, charged with overseeing the integrity of the nation’s bankruptcy courts, said it would move against lenders that file false or inaccurate claims or assess unreasonable fees.

...

Homeowners naturally look to judges to stop banks and mortgage lenders from seizing troubled borrowers’ homes without supplying proof that they actually owned the note when they began foreclosure proceedings. And with foreclosures soaring, some judges are sympathetic.

Courts in Ohio have recently dismissed cases where ownership of the note underlying the mortgage has not been proved by lenders seeking foreclosure. Last October, Christopher A. Boyko, a federal judge in Cleveland, dismissed 14 such cases.

...

But P. Randall Knece, the judge overseeing the Wellmans’ case in Pickaway County, has refused to stop the auction, even though ownership of the note at the time of foreclosure was not assigned to National City Mortgage, which is forcing the sale.

The lender, a unit of the National City Corporation of Cleveland, was cited for failure to comply with rules on loan origination and quality control and agreed to change some practices.

In terms of employment as a percentage of population, all remain below the level reached before the last recession.

...

“I’ve literally sat and cried, but my friends with double degrees are doing worse,” she says. “It’s the economy. It’s really bad.”

Now, it’s getting tougher — particularly for those at the lower rungs of the economic ladder, and especially for African-Americans like Ms. Flennaugh. As the economy slows and perhaps slides deeper into a recession that may already be under way, communities like this — cities that have long struggled with a shortage of jobs — see work becoming scarcer still.

Across the nation, the labor market has been deteriorating. Many companies, long reluctant to add workers, are hunkered down and waiting for improved prospects, engaged in what Ed McKelvey, a senior economist at Goldman Sachs, calls “a hiring strike.” Americans with jobs are taking cuts to their work hours; those without jobs are staying out of work longer, or accepting positions that pay far less than they earned previously.

...

IN many communities, dreams of upward mobility are yielding to despair and the grim realization that the economy — not strong for less-educated workers even when it was growing — may now be shrinking, making it tougher than ever to find a job.

Indeed, the increasingly anemic job market comes on the heels of six years of economic expansion that delivered robust corporate profits but scant job growth. The last recession, in 2001, was followed by a so-called jobless recovery. As the economy resumed growing, payrolls continued to shrink.

Even as job growth accelerated in 2005 and 2006 before slowing last year, it was not enough to return the country to its previous level. Some 62.8 percent of all Americans age 16 and older were employed at the end of last year, down from the peak of 64.6 percent in early 2000, according to the Labor Department.

...

In many metropolitan areas, overall employment remains below levels reached before the last recession; the list includes New York, Chicago, Detroit, Milwaukee and Buffalo, as well as Boulder, Colo.; Spartanburg, S.C.; and Topeka, Kan., according to Economy.com.

...

From 1975 to early 2000, the percentage of African-American women who were employed jumped to 59 percent from 42 percent. Two years later, following a recession, the percentage had dropped to 55 percent. Since then, employment among African-American women has shown little change, reaching 55.7 percent at the end of 2007.

...

“Why can’t I get a job?” she asks, her eyes welling with tears. “Is it because of my age? Is it because I’ve gained weight? I’m articulate. I’m a positive thinker. I know how to conduct myself in an office setting. But I’m starting to lose all my confidence.”

Government data show that the labor market has weakened in recent years for nearly every demographic group. Women as well as men; whites, blacks, Hispanics and Asian-Americans; teenagers and the middle-aged; high school graduates and those with college degrees. In terms of employment as a percentage of population, all remain below the level reached before the last recession.

...

Rather than hire and risk having to fire in another downturn, companies added hours for those already on the payroll and relied more on temporary workers, said Mr. McKelvey, the Goldman Sachs economist. Manufacturing companies continued to automate, to squeeze more production out of the same number of workers, while shifting jobs to lower-cost countries like China and Mexico. For lower-skilled workers, that intensifies the competition for the jobs that remain.

...

Before 1990, it took an average of 21 months for the economy to add back the jobs shed during a recession, according to an analysis by the Economic Policy Institute and the National Employment Law Project, a worker advocacy group. Yet in the last two recessions, in 1990 and 2001, it took 31 months and 46 months, respectively, for employment levels to recover fully.

...

OAKLAND is typical of the lean hiring that has accompanied the winnowing of jobs. In recent decades, Oakland’s once-formidable manufacturing base has hollowed out as the city has lost food processing factories, auto plants and warehouses. Downtown, concrete-floor factories have been turned into chic residential loft spaces.

...

If he doesn't understand the economy, he doesn't understand security.

...

Stiglitz was awarded the Nobel Prize for Economics in 2001. He is the author, with Linda Bilmes, of The Three Trillion Dollar War: The True Cost of The Iraq Conflict, just published in the U.S. Stiglitz spoke with me for my Global Viewpoint on Monday.

...

Joseph Stiglitz: The war has led directly to the U.S. economic slowdown. First, before the U.S. went to war with Iraq, the price of oil was $25 a barrel. It's now $100 a barrel.

While there are other factors involved in this price rise, the Iraq war is clearly a major factor. Already factoring in growing demand for energy from India and China, the futures markets projected before the war that oil would remain around $23 a barrel for at least a decade. It is the war and volatility it has caused, along with the falling dollar due to low interest rates and the huge trade deficit, that accounts for much of the difference.

That higher price means that the billions that would have been in the pockets of Americans to spend at home have been flowing out to Saudi Arabia and other oil exporters.

Second, money spent on Iraq doesn't stimulate the economy at home. If you hire a Filipino contractor to work in Iraq, you don't get the multiplier effect of someone building a road or a bridge in Missouri.

Third, this war, unlike any other war in American history, has been entirely financed by deficits. Deficits are a worry because, in the end, they crowd out investment and pile up debt that has to be paid in the future. That hurts productivity because little is left over either for public-sector investment in research, education and infrastructure or private-sector investment in machines and factories.

Until very recently, we haven't sharply felt these three factors depressing the economy because the Federal Reserve Bank responded with the attitude that they must keep the economy going no matter how much President Bush spends on the Iraq war. Seeing a weak economy, they kept interest rates low, flooded the economy with liquidity and looked the other way when bad home-lending practices were shoveling money out the door. Regulation was lax. The spigot was wide open. More than $1.5 trillion was taken out of houses in mortgage equity withdrawals alone over the past five years! That is a huge amount of money to be spent. ...

...

Gardels: The economic costs have now come back to undermine the whole post-9/11 security effort. When John McCain says he's not interested in and doesn't understand the economic aspect of things, and only knows about how to keep America safe, what does that say about his leadership capability?

Stiglitz: If he doesn't understand the economy, he doesn't understand security. If we had infinite resources, we might be able to have perfect security. But America, like every other country, has resource constraints. That means you need to be smart -- that is, economic -- about the money we spend. If you weaken the American economy, you won't be able to find the resources you need for security. The two cannot be separated.Americans' percentage of equity in their homes fell below 50 percent for the first time on record since 1945

NEW YORK - Americans' percentage of equity in their homes fell below 50 percent for the first time on record since 1945, the Federal Reserve said Thursday.

Homeowners' portion of equity slipped to downwardly revised 49.6 percent in the second quarter of 2007, the central bank reported in its quarterly U.S. Flow of Funds Accounts, and declined further to 47.9 percent in the fourth quarter — the third straight quarter it was under 50 percent.

That marks the first time homeowners' debt on their houses exceeds their equity since the Fed started tracking the data in 1945.

The total value of equity also fell for the third straight quarter to $9.65 trillion from a downwardly revised $9.93 trillion in the third quarter.

...

Moody's Economy.com estimates that 8.8 million homeowners, or about 10.3 percent of homes, will have zero or negative equity by the end of the month. Even more disturbing, about 13.8 million households, or 15.9 percent, will be "upside down" if prices fall 20 percent from their peak.

The latest Standard & Poor's/Case-Shiller index showed U.S. home prices plunging 8.9 percent in the final quarter of 2007 compared with a year ago, the steepest decline in the 20-year history of the index.

The news follows a report from the Mortgage Bankers Association on Thursday that home foreclosures skyrocketed to an all-time high in the final quarter of last year. The proportion of all mortgages nationwide that fell into foreclosure surged to a record of 0.83 percent, while the percentage of adjustable-rate mortgages to borrowers with risky credit that entered the foreclosure process soared to a record of 5.29 percent. ...

When considering tax fairness, we should ask: What exactly is a tax?

When considering tax fairness, we should ask: What exactly is a tax?

Government mandates businesses to pay for their employees’ unemployment insurance, workers’ compensation and other benefits. These payments burden businesses just as surely as if the payments were made directly to the government — a tax by another name. And if businesses fail to comply with government mandates, they can be dealt with like any tax scofflaw. ...

Wednesday, March 5, 2008

lending institutions are lobbying hard to block a proposal to allow bankruptcy judges greater latitude to rewrite mortgages

The nation's largest lending institutions are lobbying hard to block a proposal in Congress that would give bankruptcy judges greater latitude to rewrite mortgages held by financially strapped homeowners.

The proposal, which could come to a vote in the Senate as early as next week, is being pushed by Democratic congressional leaders and a large coalition of groups that includes labor unions, consumer advocates, civil rights organizations and AARP, the powerful senior citizens' lobby.

The legislation would allow bankruptcy judges for the first time to alter the terms of mortgages for primary residences. Under the proposal, borrowers could declare bankruptcy, and a judge would be able to reduce the amount they owe as part of resolving their debts.

Currently, bankruptcy judges cannot rewrite first mortgages for primary homes. This restriction was adopted in the 1970s to encourage banks to provide mortgages to new home buyers. ...

Saturday, March 1, 2008

[Credit card holders] faced a rate hike from 9 percent to as high as 28 percent if they didn't pay off their balances at the old rate

Bank of America told thousands of its cardholders in recent weeks — even those with good payment histories — that they faced a rate hike from 9 percent to as high as 28 percent if they didn't pay off their balances at the old rate and stop using their cards. The bank, the largest credit card issuer, since its 2006 acquisition of MBNA, says it's all part of its "periodic" review of customer credit risk. ...

growth of vast inequalities between the yearly payment of the financial ruling class and the medium salary of workers has reached unprecedented levels

Right wing economists have their statistics to tell them when an economy is doing well. If millions of people are jobless, homeless, starving or dying, it matters not. If the statistics point in the right direction and the rich are getting richer,

...

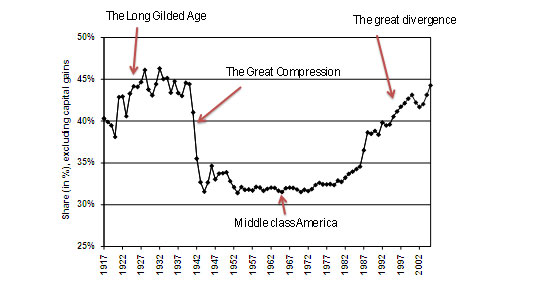

FDR’s New Deal consisted of numerous statutes that served to greatly reduce income inequality and improve the economic prosperity of the vast majority of Americans. This chart graphically shows the period of relative economic equality, which is denoted as the percent of income made by the richest 10% of Americans:

That period began in the late 1930s, as FDR’s New Deal policies began to take effect, with the percent of annual wealth made by the top 10% of Americans plunging from about 45% to about 32% (while median income greatly increased). There it remained until the “Reagan Revolution” of the early 1980s, which was characterized by a concerted and largely successful effort to dismantle FDR’s New Deal. Under George Bush II, income inequality in the United States has now attained unprecedented proportions.

...

I am not against income inequality per se. If it resulted in benefits for everyone (as in, “a rising tide lifts all boats”) or if it fairly represented the amount or value of the work that people did, I would have a very difficult time arguing against it. But the opposite of those scenarios seems to be the reality of the situation. Petras explains:

One measure of the enormous influence of the financial ruling class in heightening the exploitation of labor is found in the enormous disparity between productivity and wages. Between 2000 and 2005, the US economy grew 12 percent, and productivity (measured by output per hour worked) rose 17 percent while hourly wages rose only 3 percent. Real family income fell during the same period… Three quarters of Americans say they are either worse off or no better off than they were six years ago…. The growth of vast inequalities between the yearly payment of the financial ruling class and the medium salary of workers has reached unprecedented levels…. In 2005 the proportion of national income to GDP going to… non-wage and salary sources was at record levels – 43 percent. Inequality in the distribution of national income in the US is the worst in the entire developed capitalist world….

So why has this happened? I cannot explain it well, but Petras offers some insights which I believe explain a lot of it:

A vast army of workers, peasants and salary employees produce value which becomes the basis for… speculative financial instruments. The transfer of value from the productive activities of labor up through the trunk and branches of financial instruments is carried out through various vehicles… credit, debt leveraging, buyouts and mergers… The financial sector acts as combined intermediary, manager, proxy-purchaser and consultant, capturing substantial fees, expanding their economic empires. Finance capital is the midwife of the concentration and centralization of wealth and capital as well as the direct owner of the means of production and distribution. Finance capital has moved from exacting a larger and larger ‘tribute’ (commission or fee) on each large-scale financial transaction, toward penetrating and controlling an enormous array of economic activities…

Or, to summarize it in my unsophisticated economic language, producers produce goods and services and the financial elite, through a variety of complex financial mechanisms, find a way to… uh …. have the money transferred to themselves. ...