Congress' H-1b program is displacing daughter of Programmers Guild president out of the job marketFor years the Programmers Guild has been calling for some basic reforms to the H-1b program. Now the harm of the H-1b program is hitting home.

In May 2009, Kim's daughter Stephanie graduated from the University of Southern California (USC) with dual STEM degrees. (U.S. News ranks USC Engineering school 7th in the nation.) Stephanie completed both degrees in only four years and worked at summer internships. She has incurred student loans approaching six figures. Her resume is here - and Stephanie is willing to speak with reporters.

- M.S. Civil Engineering, Structural Engineering

- B.S. Civil Engineering, Building Science (Architectural Engineering)

- National Honor Societies: Chi Epsilon, Tau Beta Pi, Mortar Board (Webmaster), Phi Kappa Phi

- GPA: 3.840

In spite of a diligent search for work through the summer, she - along with many of her USC classmates - is unable to find a job. This is a typical response:

...

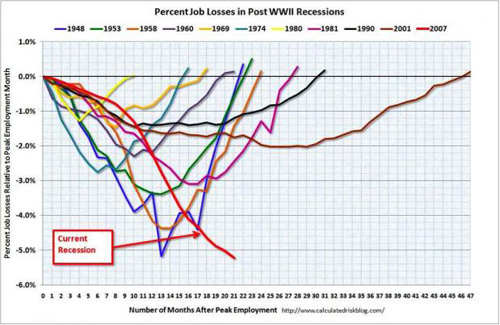

Yet, even in this worst job market in 25 years, in October 2009 Congress will flood in another 65,000 H-1b workers. In 99% of these jobs Congress did not even require that employers first try to fill these jobs with American workers.

Currently, these 65,000 jobs are unfilled. In the past, USCIS and U.S. Department of Labor (DOL) have refused to disclose these job openings - effectively reserving U.S. jobs for foreign workers:

...

Yet, even in this worst job market in 25 years, in October 2009 Congress will flood in another 65,000 H-1b workers. In 99% of these jobs Congress did not even require that employers first try to fill these jobs with American workers.

Currently, these 65,000 jobs are unfilled. In the past, USCIS and U.S. Department of Labor (DOL) have refused to disclose these job openings - effectively reserving U.S. jobs for foreign workers:

Consistently, DOL has not posted the FY 2009 Labor Condition Application (LCA) records on the DOL website: They will wait until after the jobs have been filled by temporary foreign workers - because Congress does not require that the records be disclosed prior to the jobs being filled.

Complete H-1b LCA records for prior years are on this DOL webpage. (The FY 2008 file is the source of the Excel extract in the following link.)

FACT: Stephanie is qualified to fill many of these jobs that DOL is reserving the H-1b workers.

An Excel file containing the Civil Engineering and Architectural categories of approved LCAs for FY2008 is zipped here. The jobs that pay $40,000 or less (or $20/hour or less) are highlighted in pink. ...

...

FACT: Underpaid H-1b workers are flooding into the Sacramento Region

A zipped Excel of the 1466 FY2008 LCAs for all occupations for the Sacramento Region is here. Of these, DOL only denied 4 of them. Approvals include LCAs that suggest below market wages if not H-1b fraud - such as sponsoring several H-1b workers from a residential address:

-

A $2000/month "BUSSINESS MANAGER" (sic) for www.uppal-insurance.com in Citrus Heights

-

500 "NURSES" earning $8.00/hour by "The Firm Group & Associates" in Sacramento - which Google does not find a website for.

-

Three $26,000/year "DATABASE ADMINISTRATOR" for www.key-soft.com/index.html - this one firm filed dozens of LCAs for Sacramento in FY 2008..

There are dozens more just in the Sacramento region, and thousands nationwide - comprising a substantial percentage of H-1b usage. In the Sacramento region it appears that most of the sponsors are third-party bodyshops rather than principal employers of the workers.

How do bodyshops that operate out of residences the have a critical need for foreign workers? Are these the employers that Congress fears will "relocate out of the U.S." if U.S. worker protections are added to the H-1b program? These bodyshops are not filling a shortage - instead they market their resumes and services in direct competition with the U.S. workers in this Congressional District. In some cases they receive favored treatment on contracts because they are "minority owned." On what basis does Congress give racial hiring preference to recent non-citizen immigrants over native-born citizens? ...

...

FACT: H-1b is not the only problem

Congress did not stop at the H-1b program. They also devised the L-1 visa program, which allows employers to transfer workers from overseas to work in the U.S., while still paying them their foreign wages. This has created a huge incentive for companies like Intel to set up shop in India and China, hire their graduates, then rotate those workers into the U.S. to fill the jobs with cheaper labor.

According to this image from www.cis.org Congress admitted 1.3 million foreign workers into the U.S. in FY 2008. I suspect that, in spite of the hardship Americans are having finding work, Congress will admit over on million foreign workers into the U.S. in FY 2009 - only 9000 within the "extraordinary ability" category. (Note that Stephanie forced to compete for entry-level jobs against 70,000 OPT foreign graduates): ...

...

FACT: The H-1b is harming thousands of U.S. workers

Hundreds of U.S. tech workers have detailed their personal experiences in the "H-1b Harm Report" at www.HireAmericansFirst.org. Most of these workers are willing to speak with the media. For example:

Exult My husband lost his computer programming job when his company imported cheaper programmers from India.

Lucent Technologies I was displaced from my contract position in August 2001 while the

H-1B guest workers were retained.

PG&E (San Francisco) My company was actively hiring Indian contractors through Tata and Infosys at the time I was let go.

Cognizant The company is phasing out American consultants, and later this year, American employees of that company.

MMO and SnapOn Replaced by H-1B. Spouse replaced by guest worker too.

General Electric Healthcare I am now retired from GE Healtcare, Milwaukee. I was forced into retirement at age 60, and eventually replaced by H-1B workers. Several American engineers have been replaced at GE by H-1B and green card workers.

....

els) - Scaled (82%)

els) - Scaled (82%)