The Congressional Budget Office puts out a long term analysis examining the economic health of the United States each year. ...

...

Either we increase taxes or cut spending. I’m not pushing one or the other but this is a basic math problem here.

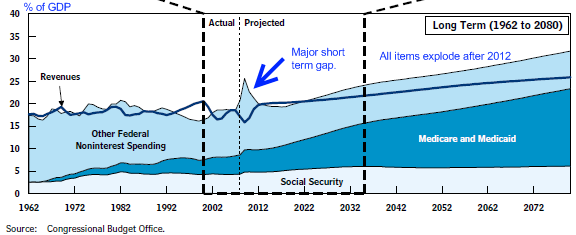

Let us take a look at the projections as put out by the CBO:

Notice that quick spike in “Other Federal Noninterst Spending” which shows the current bailout programs and fiscal stimulus. Largest spike in government spending on the chart so this should tell you the magnitude of the current recession. It is also the case that revenues are falling rapidly and that trend has not reversed. Spending is up and tax collections are down. You can tell that after 2012, the entitlement programs are going to grow at an exponential rate. We really aren’t dealing with these issues currently. At the moment all measures are focused on that blip on the chart in attempting to stabilize the economy.

I agree that the economy needs stabilization. But bailing out the banking industry with $12 trillion in explicit back stops was not the way. The FDIC has a reserve fund that is at zero and it backs up over $9 trillion in deposits. Is it smart to give this industry the right to $12 trillion in taxpayer money when clearly the CBO shows other important expenditures? Probably covering the savings of depositors is fine but this is a minor issues. Did we need to convert Goldman Sachs and Morgan Stanley into banks with easy access to the Federal Reserve? The bailouts focused on toxic debt like residential mortgages and the coming $3 trillion in commercial real estate problems.

From the chart above, it is also clear that the CBO expects income to shoot back up rather quickly and once again regain a steady course for the next 5 decades. Clearly these are rough estimates. Let us look at the latest balance sheet report from the U.S. Treasury:

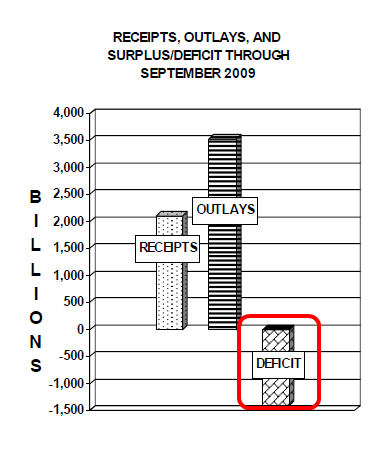

In other words, we are spending a gigantic sum more than we are bringing in. Now this isn’t something new for us. We have been doing this for years. Yet the magnitude of the current spending is enormous. If we really want to get a sense of the actual revenues and spending let us look at the U.S. Treasury monthly report:

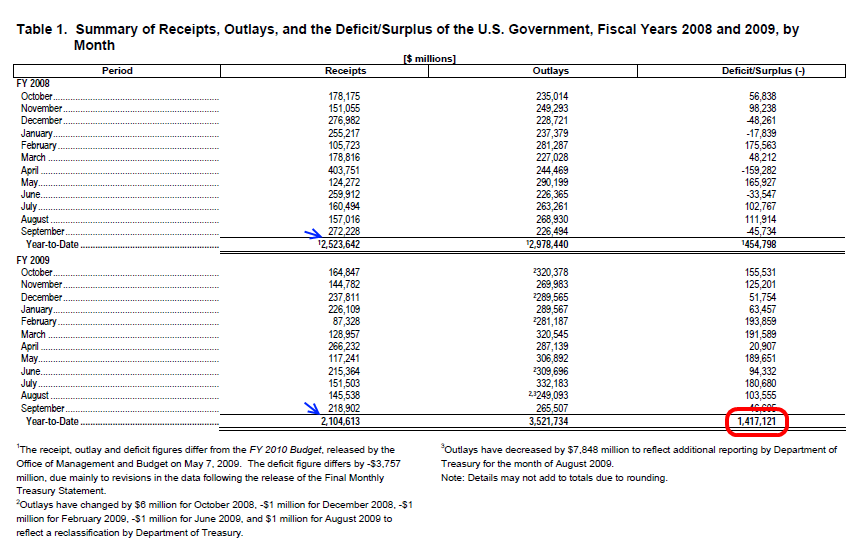

This is where the big recovery talk is lost on many. Last year in 2008, September was a horrible month for us. The entire year was troubling but September was a tipping point. With that said, the government managed to pull in $272 billion from U.S. taxpayers.

Now with the supposed recovery and all the bailouts, how did the government do in September of 2009? The government pulled in $218 billion or a year over year decrease of approximately 20 percent. This is enormous. Yet when we are hearing about all these record banking profits clearly the money isn’t going back to the government even though taxpayers bailed out these institutions. This is a major recession and the balance sheet of the government reflects this. ....

No comments:

Post a Comment