Wednesday, January 30, 2008

But the state of our Union is anything but strong. Consider these snapshots

...

But the state of our Union is anything but strong. Consider these snapshots:

1. The United States is spending more than $700 billion a year on the military. ... The United States accounts for roughly half of the world's military expenditures. [3] ... Depending on how you count, more than half of all discretionary federal spending is now directed to the military. [4]

2. Wealth is concentrating in the United States at a startling rate. ... The concentration of wealth and income reflects a major shift over the last three decades in how the United States shares its earnings. In 1976, the top 1 percent of the population received 8.83 percent of national income. In 2005, they grabbed 21.93 percent. [5] ....

3. Compensation for CEOs and Wall Street financiers is out of control ... The average CEO from a Fortune 500 company now makes 364 times an average worker's pay, reports the Institute of Policy Studies. This is up from a 40-to-1 ratio in 1980. ... But the managers of businesses that make things and deliver non-financial services aren't making the truly big money these days. In the hyper-financialized economy, it's the finance guys who are getting truly rich....

4. Corporations are capturing more of the nation's wealth. Corporate profits amounted to 8 percent of GDP over the last decade, Business Week reports, up from 6.5 percent in the early 1990s. [8]

5. The housing bubble and the subprime mortgage meltdown are driving millions of families from their homes. ... Overall losses from deflated housing values may top $2 trillion. ...

6. The racial wealth divide remains a chasm with little prospect of being bridged -- and is likely growing worse. ... At the rate the wealth divide closed between 1982 and 2004, it would take 594 more years for African Americans to achieve parity with whites, ...

7. Women continue to be paid far less than men. ...

8. More than one in six children live in poverty. ...

9. More than 45 million people in the United States do not have health insurance. ...

10. The U.S. trade deficit is more than 5 percent of the gross domestic product. The average fuel economy of today's U.S. car and truck fleet is 25.3 miles per gallon, reports the Union of Concerned Scientists, lower than the 25.9 mpg fleet average in 1987. ...

12. The nation's infrastructure is crumbling. ...

13. More than two million people in the United States are locked in prison. What a colossal waste of human talent. 2,258,983 prisoners were held in Federal or State prisons or in local jails, at the end of 2006, an increase of 2.9 percent from 2005.

list of presidents who would envy the Bush economic record is as follows: 1. Bush I. 2. Nobody

...

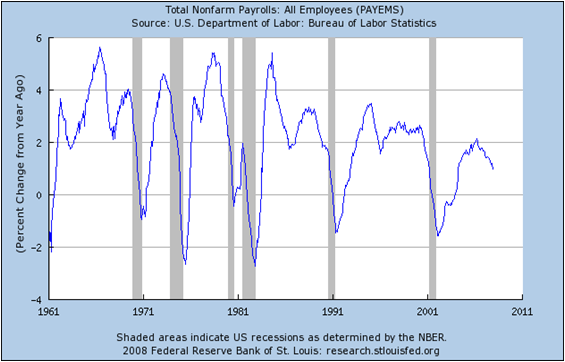

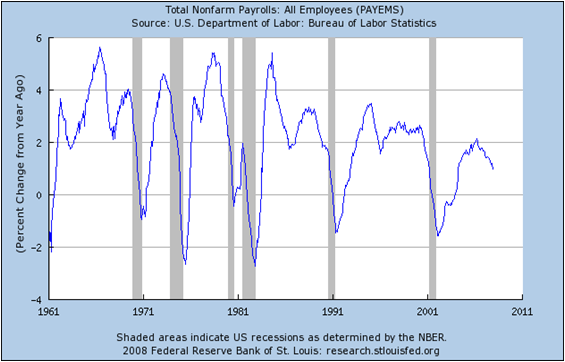

On one side, the Bush economy, even during its good years, wasn’t all that great. I’ve given readers a lot of charts on this; here’s another, the rate of growth of nonfarm payroll employment.

Looking at this, which presidents, exactly, would the Bush economic climate be the envy of? Even at its best, the Bush economy failed to deliver employment growth comparable to that under earlier presidents. And the Bush economy spent very little time at its best. Only Gerald Ford and Bush the elder failed to deliver performance better than the current occupant of the White House.(Jimmy Carter simply had the misfortune to have a recession at the end of his tenure.)

...

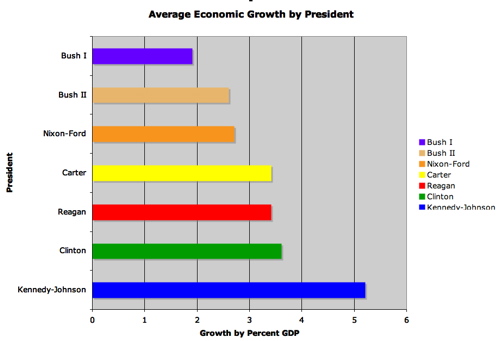

Update: Dean Baker had the same reaction. He uses GDP growth rates and lumps Nixon-Ford together, so that his list of presidents who would envy the Bush economic record is as follows: 1. Bush I. 2. Nobody.

Update 2: Ezra Klein makes it into a nice chart.

Decrease in median income from 2000-2006 in White American households: $745

WASHINGTON, Jan. 28 /PRNewswire-USNewswire/ -- President Bush is expected to address problems in the nation's economy while hailing the state of the union as strong tonight, but for Americans worrying about how to make ends meet, the country is headed in the wrong direction, according to numbers compiled today by the Campaign for America's Future.

ON INCOMES:

-- Median household income in 2000 (inflation-adjusted): $49,158

-- Median household income in 2006: $48,201

-- 8-year increase in median household income in 2001: $6,000

-- 6-year decrease in median household income in 2007: $1,100

[U.S. Census Bureau, 2000 - 2007]

-- Salary of a full-time minimum wage employee without vacation: $12,168

-- Average salary of a CEO of one of America's top 500 companies: $15.2 million

[Forbes Magazine, May 3, 2007]

-- Number of Americans living in poverty in 2001: 31.6 million

-- Number of Americans living in poverty in 2008: 36.5 million

[U.S. Census Bureau, Aug. 2007]

-- Amount more Americans earned than spent in 2001: +2.3 percent

-- Amount less Americans are earning than spending in 2008: -0.5 percent

[Bureau of Economic Analysis]

-- Total consumer credit debt in 2001: $7.65 trillion

-- Total consumer credit debt in 2008: $12.8 trillion

[Insurance Information Institute]

-- Decrease in median income from 2000-2006 in White American households: $745

-- Decrease in median income from 2000-2006 in African American households: $2,766

-- Decrease in median income from 2000-2006 in Hispanic American households: $1,043

-- Decrease in median income from 2000-2006 in Asian American households: $1,381

[U.S. Census Bureau. Aug. 2007]

ON HOUSING: [RealtyTrac. Dec. 19, 2007]

-- Percentage increase in home foreclosures in the last year: 68

ON JOBS: [Bureau of Labor Statistics.]

-- Total number of American manufacturing jobs in 2000: 17,263,000

-- Total number of American manufacturing jobs in 2006: 14,197,000

-- Number of American manufacturing jobs lost between 2000 and 2006: 3,066,000

-- Yearly average number of new private sector jobs created from 1992-2000: 1.76 million

-- Yearly average number of new private sector jobs created from 2001-2008: 369,000

our nation has regressed to the highest level of inequality seen since what Paul Krugman refers to as “The Long Gilded Age”

President Franklin Roosevelt’s New Deal contained numerous statutes that served to greatly reduce income inequality, which is denoted in the above chart as the percent of income made by the richest 10% of Americans. Beginning in the late 1930s, after several decades of the least amount of income inequality in American history, coinciding with the greatest sustained economic boom in U.S. history, the situation began to reverse itself with the onset of the “Reagan Revolution” in 1981. Under George Bush II, income inequality has now again attained Gilded Age proportions.

And not coincidentally, along with this rise in income inequality, we have seen a large increase in poverty under Bush the 2nd, with 5 million more Americans descending into poverty by 2004, to reach a total of 37 million, reflecting the increasing poverty rate in our country under Bush, as depicted in this graph:

...

Fighting poverty is the cornerstone of John Edwards’ campaign for President in 2008. In a previous post I discussed the fact that his plans to address this issue are far superior to those of any other presidential candidate. A recent editorial in The Nation, titled “Time to Act on Inequality”, dealt with this issue, recognizing Edwards’ leadership: ...

...

Accusations that Edwards is angry, aggressive, and confrontational

One of Edwards’ biggest problems has been a relative blackout by our corporate news media. When the media is forced to acknowledge him, as during the 3-way debate in South Carolina last week, his popularity surges. But when our corporate news media isn’t blacking him out they generally have nothing but criticism for him. These criticisms, when they don’t deal with trivia such as the price of his haircuts, generally deal with his confrontational stance towards corporate greed. One example is the Des Moines Register, which recently explained why they decided not to endorse his candidacy this year:

"It is time to give these entrenched interests, that are standing against America, hell," Edwards told thousands of Iowa Democrats this month at the state party's fall fundraiser in Des Moines. "That's the only way we're going to win this fight."

Oh my! Not only does he talk about economic inequality, but he prescribes aggressive measures to combat it!

And here is some more aggressive criticism of Edwards’ campaign, by Stuart Rothenberg:

Given the North Carolina Democrat’s rhetoric and agenda, an Edwards Presidency would likely rip the nation apart – even further apart than Bush has torn it. For while Edwards bashes corporate America and “them,” this nation’s economy depends on the success of both small business and big business. Scare the stuffing out of Corporate America and watch the stock market tumble.

So, apparently it’s inconsistent to fight for both the working class and the middle class? And railing against George Bush’s corporate agenda is going to tear our nation apart? Give me a break! Rothenberg’s claim that criticizing corporate America will hurt our economy is reminiscent of Ronald Reagan’s trickle down economic theories.

Edwards’ answer to those accusations – an inconvenient truth

Yes, corporate America fears an Edwards presidency. And yes, as Dan Balz explains:

State of the union: labor force participation fell sharply, median wages fell 1.4%, no current savings over 7 years, large deficit in adv. technology

In just the past seven years, U.S. household debt almost doubled and federal debt soared by near two-thirds, rocketing by a combined $10.5 trillion. The total combined debt of households ($14.4 trillion) and the federal government ($9.2 trillion) is now 168 percent of GDP, far higher even than in the brief spike during World War II. All other levels and ratios of debt also have soared far beyond any past precedent.

Yet, this record-shattering explosion of debt stimulus created the weakest seven-year job growth (4.4 percent) and one of the weakest periods of real GDP growth (18.1 percent) since the Depression: less than 6 million new jobs ($1.8 million of debt per job) and a mere $4 trillion increase in GDP.

...

... Locked into a failed, 30-year-old ideology of deregulation and debt, there is still no option to compete with the remarkably effective industrial and trade policies pursued by China and others.

...

Record trade losses have accelerated the hollowing-out of the once dynamic U.S. economy. For the first time on record, in 2002 the United States lost its historic global trade surplus in advanced technology products (ATP). Worsening sharply, since 2004 the ATP deficit became larger than the U.S. trade surplus for intellectual property services, royalties and fees. That is, for the past four years the United States has a worsening combined deficit in technology goods and services. Technology no longer pays any part of the U.S. import bills for oil, cars, electronics and clothing, etc. China now accounts for half the U.S. manufacturing trade deficit and more than the entire deficit in technology.

...

... since 2001 the labor force has grown more slowly (7.4 percent) than during any seven-year period since 1955 and participation rate of those in the labor force -- those working or looking for work -- also fell sharply -- from 67 percent to 66 percent.

...

Median real wages have continued to decline, including by 1.4 percent over the past year. Median household real incomes fell 2.0 percent from 2000 to 2006 (latest data available) and even the average income fell 0.5 percent with inequality now the worst on records back to the 1960s. The total current savings of ALL households over the past three years is virtually nothing; by far the worst since 1933.

The foolishness of powerful, self-interested claims of a "new paradigm" is again exposed. The fantasy is that soaring debt and the loss of production through trade deficits are good things and the lack of current savings irrelevant. ....

The number of manufacturing jobs has fallen to the level of 65 years ago.

It is difficult to know where Bush has accomplished the most destruction, the Iraqi economy or the US economy.

In the current issue of Manufacturing & Technology News, Washington economist Charles McMillion observes that seven years of Bush has seen the federal debt increase by two-thirds while US household debt doubled.

This massive Keynesian stimulus produced pitiful economic results. Median real income has declined. The labor force participation rate has declined. Job growth has been pathetic, with 28% of the new jobs being in the government sector. All the new private sector jobs are accounted for by private education and health care bureaucracies, bars and restaurants. Three and a quarter million manufacturing jobs and a half million supervisory jobs were lost. The number of manufacturing jobs has fallen to the level of 65 years ago.

This is the profile of a third world economy.

The "new economy" has been running a trade deficit in advanced technology products since 2002. The US trade deficit in manufactured goods dwarfs the US trade deficit in oil. The US does not earn enough to pay its import bill, and it doesn't save enough to finance the government's budget deficit. ...

...

As the dollar sheds value and loses its privileged position as reserve currency, US living standards will take a serious knock. ...

Why the Debt Crisis Is Now the Greatest Threat to the American Republic ... insane spending on "defense", eroding manufacturing, infrastructure ....

The military adventurers of the Bush administration have much in common with the corporate leaders of the defunct energy company Enron. Both groups of men thought that they were the "smartest guys in the room," the title of Alex Gibney's prize-winning film on what went wrong at Enron. The neoconservatives in the White House and the Pentagon outsmarted themselves. They failed even to address the problem of how to finance their schemes of imperialist wars and global domination.

As a result, going into 2008, the United States finds itself in the anomalous position of being unable to pay for its own elevated living standards or its wasteful, overly large military establishment. ...

...

There are three broad aspects to our debt crisis. First, in the current fiscal year (2008) we are spending insane amounts of money on "defense" projects that bear no relationship to the national security of the United States. ...

Second, we continue to believe that we can compensate for the accelerating erosion of our manufacturing base and our loss of jobs to foreign countries through massive military expenditures -- so-called "military Keynesianism," ...

Third, in our devotion to militarism (despite our limited resources), we are failing to invest in our social infrastructure and other requirements for the long-term health of our country. These are what economists call "opportunity costs," things not done because we spent our money on something else. Our public education system has deteriorated alarmingly. We have failed to provide health care to all our citizens and neglected our responsibilities as the world's number one polluter. Most important, we have lost our competitiveness as a manufacturer for civilian needs -- an infinitely more efficient use of scarce resources than arms manufacturing. ...

short-term responses to our complex economic problems, nothing more than bandages for a hemorrhaging economy

...

But all of us should recognize that the stimulus package will be inadequate to drive sustainable growth in our $13 trillion economy. An emergency Fed rate cut and an economic stimulus plan are short-term responses to our complex economic problems, nothing more than bandages for a hemorrhaging economy.

...

We all have to acknowledge that our problems were in part brought on by the failure of our government to regulate the institutions and markets that are now in crisis. The irresponsible fiscal policies of the past decade have led to a national debt that amounts to $9 trillion. The irresponsible so-called free trade policies of Democratic and Republican administrations over the past three decades have produced a trade debt that now amounts to more than $6 trillion, and that debt is rising faster than our national debt. All of which is contributing to the plunge in the value of the U.S. dollar.

...

... The truth is that consumers spend most of their money on foreign imports, and any stimulus package probably would be stimulating foreign economies rather than our own. Imports, for example, account for 92 percent of our non-athletic footwear, 92 percent of audio video equipment, 89 percent of our luggage and 73 percent of power tools. In fact, between 1997 and 2006, only five of the 114 industries examined in a U.S. Business and Industry Council report gained market share against import competition. ..

Monday, January 28, 2008

State of My Union Address ... out of work IT job oustourced [overseas], no health insurance,

Good evening, ladies and gentleman, fellow citizens, and thank you for your time. Thank your for the opportunity to present the State of My Union. I know several important topics are on the minds of my fellow Americans today, and I will give you my views on those topics as they relate to my Union's current situation.

Perhaps the number one topic today is the economy, equal to or followed closely by the war in Iraq. We'll address the economy first. Let's see. I was employed in an IT job for 7 years from 2000 to 2006 until my entire department was outsourced. Falling back on my construction knowledge, I went through two jobs until I was laid off last October. Since then, I have applied at 40+ companies in the area and have had 2 interviews. I am collecting unemployment, living check to check. My wife still has her job, thank goodness, but the lengthy commute results in higher cost as gas prices rise. Rising food prices are also a factor as we try to feed a family of four. As far as I can tell, the outlook on the employment and economy don't look so good. Sorry I don't have better news, but I don't see our corrupt and thieving government turning things around.

The war in Iraq rolls on, a dismal failure by any measure. It began with lies, continues only to profit business and continues to kill our finest. With no exit strategy, looks like nothing will change anytime soon and I don't see any of the leading candidates getting us out any time soon either.

I know many Americans are concerned with medical care. Here's how it works in my Union. Just before Christmas, I was hospitalized with an out-of-the-blue heart problem. I had been totally healthy prior to this. I spent 5 days in the hospital- the bill was $26,000. I'm not employed and have no insurance. Thank goodness the hospital wrote off 90% as charity. After getting the bills from the doctors and others who don't do charity, my bills total about $5000.00. And of course since I have no insurance, I pay full retail- much more than an insurance company would pay for the same services. Since I have no savings, I have no idea how I'll pay. If I was the government, I wouldn't have to worry- just fire up the printing press and print some cash, but for us mere mortals, that's not an option. The hospital says I need to see a cardiologist ASAP, but with no insurance, I'm not sure I can afford it or will be accepted as a patient. Maybe I'll try the VA.

This is an election year and this Union doesn't see much change on the horizon. You can bet the new President will put Israel and special interests before the benefit of the American people. Whoever the new President is, they have already been selected by the powers that be and will be put into office via vote fraud. After going through the meaningless ritual of voting, we'll just be the last to know who the chosen one is.

Well, that pretty much sums up the State of My Union. ...

Tuesday, January 22, 2008

The US now has fewer manufacturing jobs than it had in 1950 when the population was half the current size.

...

The Bush administration is turning to tax rebates, because problems in the financial system and the amount of consumer debt hinder the Federal Reserve's ability to pump money to consumers through the banking system. Like an easy credit, low interest rate policy, the purpose of a tax rebate is to put money in consumers' hands in order to boost consumer demand.

Will consumers spend the rebate, or will they use it to pay down their debts? If they spend the rebate on consumer goods, will it provide much boost to the economy?

Many Americans are overloaded with debt and will have to use the rebate to pay down credit card debt. The gift of $800 per means-tested taxpayer is really just a partial bailout of heavily indebted consumers and credit card companies.

The percentage of the rebate that survives debt reduction will be further drained of effect by Americans' dependency on imports. According to reports, 70% of the goods on Wal-Mart shelves are made in China. During 2006, Americans spent $1,861,380,000,000 on imported goods, that is, 23% of total personal consumption expenditures were spent on imports (including offshored goods).

Americans worry about their dependency on imported energy, but the $145,368,000,000 paid to OPEC in 2006 is a small part of the total import bill. Americans imported $602,539,000,000 in industrial supplies and materials; $418,271,000,000 in capital goods; $256,660,000,000 in automotive vehicles, parts and engines; $423,973,000,000 in manufactured consumer goods; and $74,937,000,000 in foods, feeds and beverages.

...

Today Americans are losing jobs for reasons that have nothing to do with recession. They are losing their jobs to offshoring and to foreigners brought in on work visas. Today many American brands are produced offshore in whole or part with foreign labor and imported to the US for sale in the American market. In 2007, prior to the onset of the 2008 recession, 217,000 manufacturing jobs were lost. The US now has fewer manufacturing jobs than it had in 1950 when the population was half the current size. ...

Soaring fuel prices have altered the equation for growing food and transporting it across the globe. Huge demand for biofuels creates tension ...

KUANTAN, Malaysia — Rising prices for cooking oil are forcing residents of Asia’s largest slum, in Mumbai, India, to ration every drop. Bakeries in the United States are fretting over higher shortening costs. And here in Malaysia, brand-new factories built to convert vegetable oil into diesel sit idle, their owners unable to afford the raw material.

...

The food price index of the Food and Agriculture Organization of the United Nations, based on export prices for 60 internationally traded foodstuffs, climbed 37 percent last year. That was on top of a 14 percent increase in 2006, and the trend has accelerated this winter.

In some poor countries, desperation is taking hold. Just in the last week, protests have erupted in Pakistan over wheat shortages, and in Indonesia over soybean shortages. Egypt has banned rice exports to keep food at home, and China has put price controls on cooking oil, grain, meat, milk and eggs.

According to the F.A.O., food riots have erupted in recent months in Guinea, Mauritania, Mexico, Morocco, Senegal, Uzbekistan and Yemen.

...

A startling change is unfolding in the world’s food markets. Soaring fuel prices have altered the equation for growing food and transporting it across the globe. Huge demand for biofuels has created tension between using land to produce fuel and using it for food. ...

Bush proposed to hand out cash tax rebates--except to families earning less than $40,000 a year.

...

n a typically regressive gesture, Bush proposed to hand out cash tax rebates--except to families earning less than $40,000 a year. This may qualify as an example of what Naomi Klein calls "disaster capitalism," in which any misfortune can be re-jiggered to the advantage of the affluent. ...

Five+ regulatory failures led to the current crisis: Trade deficit, housing bubble, ratings agencies, predatory lenders, financial "innovation"

...

The current crisis is the predictable (and predicted) result of a massive U.S. housing bubble, which itself can be traced in part to global economic imbalances that could have been prevented.

At least five distinct regulatory failures led to the current crisis.

Regulatory Failure Number One: Failure to Manage the U.S. Trade Deficit. ....

Regulatory Failure Number Two: Failure to Intervene to Pop the Housing Bubble. ...

Regulatory Failure Number Three: Financial Deregulation and Unchecked Financial "Innovation." ... In the new era, banks and non-bank mortgage lenders made loans, but then sold the loans to others. Investment banks packaged lots of mortgage loans into "Collateralized Debt Obligations" (CDOs) and then sold them on Wall Street, with a promise of a steady stream of revenue from interest payments. These operations were pretty much unregulated. ...

Regulatory Failure Number Four: Private Regulatory Failure. It was the job of ratings agencies (like Standard and Poor's, and Moody's) to assess the CDOs and give investors guidance on how risky they were. They failed totally, likely in part because they wanted to maintain good relations with the investment banks issuing the CDOs.

Regulatory Failure Number Five: No Controls Over Predatory Lenders. The toxic stew of financial deregulation and the housing bubble created the circumstances in which aggressive lenders were nearly certain to abuse vulnerable borrowers. ...

...

... Preventing financial panics of the kind now underway require new standards of transparency and regulation for high finance. The coming days and months will tell whether any lessons have been learned. ...

Monday, January 21, 2008

The rich are getting fabulously richer, ... and the bottom half are being savaged by our current economic policies.”

I think of the people running this country as the mad-dashers, a largely confused and inconsistent group lurching ineffectively from one enormous problem to another.

...

Now, like children who have eaten too much sugar, they are frantically trying to figure out how to put a few dollars into the hands of working people to stimulate an enfeebled economy.

They should stop, take a deep breath and acknowledge the obvious: the way to put money into the hands of working people is to make sure they have access to good jobs at good wages. That has long been known, but it hasn’t been the policy in this country for many years.

Big business and the federal government have worked hand in hand to squeeze the daylights out of working people, stripping them (in an era of downsizing and globalization) of much of their bargaining power while ferociously pursuing fiscal policies that radically favored the privileged few.

...

From 1980 to 2005 the national economy, adjusted for inflation, more than doubled. (Because of population growth, the actual increase per capita was about 66 percent.) But the average income for the vast majority of Americans actually declined during that period. The standard of living for the average family has improved not because incomes have grown, but because women have gone into the workplace in droves.

The peak income year for the bottom 90 percent of Americans was way back in 1973 - when the average income per taxpayer (adjusted for inflation) was $33,001. That is nearly $4,000 higher than the average in 2005.

It’s incredible but true: 90 percent of the population missed out on the income gains during that long period.

Mr. Johnston does not mince words: “The pattern here is clear. The rich are getting fabulously richer, the vast majority are somewhat worse off, and the bottom half - for all practical purposes, the poor - are being savaged by our current economic policies.”

...

Economic alarm bells have been ringing in the U.S. for some time. There was no sense of urgency as long as those in the lower ranks were sinking in the mortgage muck and the middle class was raiding the piggy bank otherwise known as home equity.

...

Forget all the CNBC chatter about Fed policy and bargain stocks. For ordinary Americans, jobs are the be-all and end-all. And an America awash in new jobs will require a political environment that respects and rewards work and aggressively pursues creative policies designed to radically expand employment. ...

long-term unemployment is growing most rapidly among white-collar and college-educated workers with long work experience

...

In November, nearly 1.4 million people -- almost one in five of those unemployed -- had been jobless for at least 27 weeks, the juncture when unemployment insurance benefits end for most recipients. That is about twice the level of long-term unemployment before the 2001 recession.

The problem is ensnaring a broader swath of workers than before. Once concentrated among manufacturing workers and those with little work history, education or skills, long-term unemployment is growing most rapidly among white-collar and college-educated workers with long work experience, studies have found, making the problem difficult for policymakers to address even as it grows more urgent.

"What has happened is a polarization of the labor market. It was very strong at the very top and very strong until recently at the bottom," said Lawrence F. Katz, a labor economist at Harvard University. "But in the recent weak recovery, and now recession, demand has been very weak" for jobs in the middle. ...

[Bush legacy] Along with low, or no, job growth. Little or no business growth. Depressed wages. And the crashing dollar.

The New York Times made it official. The Economy is a problem!

...

It's blamed, mostly, on the subprime crisis.

But that's not the problem. It's a symptom. It is the logical, and probably one of the necessary results, of Bushenomics.

Along with low, or no, job growth. Little or no business growth. Depressed wages. And the crashing dollar. (The president has a different vision of the economy. In his vision it's booming! And the number of jobs is growing! Though there is this little blip.)

The idea under which Bushenomics was sold is this:

* The rich are the investor class.

* If the rich have more money, they will invest more.

* Their investments will create more business.

* Those businesses will create more wealth, thus improving everyone's lives and making the nation stronger. They will also create new and better jobs.

...

A more realistic -- and less idealistic -- view of Bushenomics is that the Bush administration and its cronies came at the economy with the attitude of oilmen.

* They inherited a vastly wealth country.

* They looked at it like the oil under the Alaskan wilderness. They craved to pump it out, turn it into cash and grab as much of that cash as possible.

...

... Our biggest asset -- in terms of size -- is, of course, our defense establishment. With privatization, one dollar out of every three for direct military operations in Iraq and Afghanistan goes to private contractors like Halliburton and Blackwater. ...

...

This is just an estimate. The degree of privatization is unknown. Presumably, that's deliberate. ...

...

But for the most part, the assets of the United States, our collective wealth, could not be sold off in such a direct manner.

In order to turn them into cash, what the administration did was borrow against them.

That is, they cut taxes while continuing to spend lavishly, creating debt.

The debt is owed by all of us, the collective people of the United States.

The tax cuts hugely favored rich people. They also favored unearned income (dividends, capital gains, inherited money) as opposed to the kind of money people have to work for. The very richest got richer.

The spending was -- to the degree possible -- directed to themselves, their friends and their supporters: Big Pharma, the medical industry, insurance, banking and financial, among others. And, of course, Big Oil, from whom they have spent close to a trillion dollars of our money to conquer a big oil field for private exploitation. ...

The big number is that the economy has grown.

As measured by the GDP it has. From 2001 to 2007 it went by 35 percent.

...

Now let us look at job creation.

In the first six years of the Clinton administration, 13.7 million jobs were created. In the same period, under Bush, only 3.7 million jobs were created. Barely keeping up with population growth, if that. (Source: Fox News)

Now let us look at median income. That's as opposed to average income (If Bill Gates walks into a bar with 10 people, the average income of everyone in the room goes up by $17,5000,000. But the median income just moves up half a notch, from between the fifth and sixth person, to the sixth person's income). From 2001 to 2005, median income, for people under 65, went down $2,000.

...

Now, let's look at the value of America's businesses.

A good rough measure of the market value of America's best businesses is the stock market. Under Clinton, the Dow Jones went up 324 percent. Wall-to-wall, after the dot.com bubble burst, it more than tripled in value.

Bush arrived in 2001. Since then the Dow Jones is up just 10 percent. Adjusted for inflation, that's absolutely flat. (It was briefly up 23 percent. It is now below the 10 percent mark, and tumbling down as this is written). Just pain, no gain.

...

The subprime crisis, the housing bubble, whatever you want to call it, is not the problem.

It's a symptom of pumping in money with no place to go.

Other symptoms are no job growth, no business growth, no stock market growth, falling median incomes, disappearing pensions and health plans, and the fall of the dollar.

When Bush came into office, a Euro cost 95 cents. Now it costs a $1.50. The Canadian dollar (the Loony) was 70 cents. Now it costs a dollar. Most mainstream economists and pundits will opine that a low dollar is good for American industry, because it will help us sell our goods. That's only true if we're producing things that no one else is -- or producing them better or cheaper -- and we're not.

...

In the real world, there are no such things as free markets.

In the real world, business people manipulate and conspire to control markets, and governments both control and collude with business, while tax policies and government spending have a major affect on the economy.

...

Thursday, January 17, 2008

prices rose by 4.1 percent -- highest since 1990 -- prices of essentials climb far more steeply ... worse if not for China

WASHINGTON — New data from the Labor Department confirm what most middle-class Americans already know: Inflation is squeezing them.

As consumer prices rose by 4.1 percent last year, the highest rate since 1990, the prices of basic essentials such as food, gasoline and health insurance climbed far more steeply, explaining why so many Americans are telling pollsters that the economy is their chief concern.

The Bureau of Labor Statistics reported Wednesday that the price of food and beverages rose 4.8 percent. At the same time, real weekly earnings failed to keep pace, rising 0.9 percent for the year. In the simplest of terms, a dollar earned bought less.

...

Digging deeper into the data reveals, for example, that the price of bread rose 7.4 percent last year, almost twice the rate of inflation.

The price of eggs rose 29.2 percent in 2007, while the price of fresh whole milk was up 13.1 percent. Since July, when milk prices first soared, the price of fresh whole milk has risen by almost 23 percent.

"The kinds of things you purchase every day are going up (in price)," ... "People who are at the lower end of the income scale are going to feel that more."

...

The inflation news would be worse if not for China. Prices for the types of consumer goods that are coming almost exclusively from China were down last year as in earlier years, serving to hold back broader U.S. consumer inflation.

Apparel prices fell 0.4 percent in 2007, footwear prices fell 0.9 percent and the price of furniture and bedding — China- and Brazil-dominated products that once were the domain of the Carolinas — fell by 0.9 percent.

The price of toys, which now come mostly from China, fell 4.7 percent last year. It's fallen every year since 1997.

In this economic climate, businesses and the consuming classes need help ... oach coupled with an increase of t

The Bush tax cuts have created a scenario in which the lions's share of the benefit have gone to rich individuals furthering the gap between the rich and the other economic classes. The reduction and elimination of the estate tax puts even more wealth into the upper 1% of families. As a result, rich individuals have increased their wealth geometrically. However, Bush did not give any rate cuts to corporations. Let's analyze this.

Supply-side economics is a school of macroeconomic thought that argues that economic growth can be most effectively created using incentives for people to produce (supply) goods and services, such as adjusting income tax and capital gains tax rates. This can be contrasted with the classic Keynesian economics (or "demand side economics"), which argues that growth can be most effectively managed by controlling total demand for goods and services, typically by adjusting the level of Government spending. Supply-side economics is often conflated with trickle-down economics, a derogatory term given to right leaning economist's views by political opponents (source: Wikipedia). The key phrase is: using incentives for people to produce (supply) goods and services. The people who produce goods and services are businesses most of which are corporations. Labor produces goods and services with the oversight of corporate executives.

If Bush were to be true to supply side theory, the tax incentives would have been given to the corporations and unincorporated businesses. Tax cuts could have been easily targeted to businesses. The big lie in all of this is that there was only a giveaway to rich individuals and not businesses. One could argue that a reduction in business taxation coupled with a reduction in middle class taxation could stimulate the economy. That concept is neither supply side or Keynesian economics. I would label this as a hybrid so let's call this concurrent tax cut Drobnyian economics. In this economic climate, businesses and the consuming classes need help and this measure would be a reasonable approach coupled with an increase of taxes for the rich.

There was no intent to provide economic substance to the giveaways to the rich authorized by Bush. As demonstrated above, there is no supply side benefit to these tax cuts. Bush falsely gives the argument that the wealthy families will somehow reinvest their tax savings into business ventures. The fact is that the increase in family wealth afforded by these tax cuts were put primarily into securitzed funds. In the 90's, excess wealth was put mostly into venture capital funds. ....

Consumer prices rose in 2007 at the fastest pace in 17 years ... Average weekly earnings (adjusted) ... DROPPED by 0.9 percent

WASHINGTON - Consumer prices rose in 2007 at the fastest pace in 17 years as motorists paid a lot more for gasoline and grocery shoppers paid higher food bills. However, falling prices for clothing and new cars offset some of those gains.

The Labor Department reported that consumer prices rose by 4.1 percent for all of 2007, up sharply from a 2.5 percent increase in 2006. Both energy and food prices jumped by the largest amount since 1990.

...

Workers' wages failed to keep up with the higher inflation. Average weekly earnings, after adjusting for inflation, dropped by 0.9 percent in 2007, the fourth decline in the past five years. The lagging wage gains are cited as a chief reason many workers have growing anxiety about their economic futures. ...

Wednesday, January 16, 2008

Chamber of Commerce vows to punish anti-business candidates ... spend more than $60m in presidential race

“We plan to build a grass-roots business organization so strong that when it bites you in the butt, you bleed,” chamber President Tom Donohue said.

The group indicates it will spend in excess of the approximately $60 million it put out in the last presidential cycle.

WASHINGTON -- Alarmed at the increasingly populist tone of the 2008 political campaign, the president of the U.S. Chamber of Commerce is set to issue a fiery promise to spend millions of dollars to defeat candidates deemed to be anti-business.

"We plan to build a grass-roots business organization so strong that when it bites you in the butt, you bleed," chamber President Tom Donohue said. ...

...

Presidential candidates in particular have responded to the public concern. Former Sen. John Edwards of North Carolina has been the bluntest populist voice, but other front-running Democrats, including Sen. Hillary Rodham Clinton of New York and Sen. Barack Obama of Illinois, have also called for change on behalf of middle-class voters.

On the Republican side, former Arkansas Gov. Mike Huckabee -- emerging as an unexpected front-runner after winning the Iowa caucuses -- has used populist themes in his effort to woo independent voters, blasting bonus pay for corporate chief executives and the effect of unfettered globalization on workers. ...

amazing 84 percent in a poll earlier in 2007 that big companies have too much power in Washington ... [only 79 % believe earth circles sun !!!

15/01/08 "Counterpunch" -- -- The U.S. public holds Big Business in shockingly low regard.

A November 2007 Harris poll found that less than 15 percent of the population believes each of the following industries to be "generally honest and trustworthy:" tobacco companies (3 percent); oil companies (3 percent); managed care companies such as HMOs (5 percent); health insurance companies (7 percent); telephone companies (10 percent); life insurance companies (10 percent); online retailers (10 percent); pharmaceutical and drug companies (11 percent); car manufacturers (11 percent); airlines (11 percent); packaged food companies (12 percent); electric and gas utilities (15 percent). Only 32 percent of adults said they trusted the best-rated industry about which Harris surveyed, supermarkets. [1]

These are remarkable numbers. It is very hard to get this degree of agreement about anything. By way of comparison, 79 percent of adults believe the earth revolves around the sun; 18 percent say it is the other way around.[2]

The Harris results are not an aberration. The results have not varied considerably over the past five years -- although overall trust levels have actually declined from the already very low threshold in 2003.

The Harris results are also in line with an array of polling data showing deep concern about concentrated corporate power.

An amazing 84 percent told Harris in a poll earlier in 2007 that big companies have too much power in Washington. By contrast, only 47 percent said that labor unions have too much power in Washington (as against 42 percent who said labor has too little power), and 18 percent who said nonprofit organizations have too much power in Washington.[3] ...

America, to pay her bills, has begun to sell herself to the world

15/01/08 "Worldnet" -- - -Since it began to give credit ratings to nations in 1917, Moody's has rated the United States triple-A. U.S. Treasury bonds have been seen as the most secure investment on earth. When crises erupt, nervous money seeks out the world's great safe harbor, the United States. That reputation is now in peril.

Last week, Moody's warned that if the United States fails to rein in the soaring cost of Social Security, Medicare and Medicaid, the nation's credit rating will be down-graded within a decade.

...

We are thus in the position of having to borrow from Europe to defend Europe, of having to borrow from China and Japan to defend Chinese and Japanese access to Gulf oil, and of having to borrow from Arab emirs, sultans and monarchs to make Iraq safe for democracy.

We borrow from the nations we defend so that we may continue to defend them. To question this is an unpardonable heresy called "isolationism."

And the chickens of globalism are coming home to roost.

We let Europe to get away with imposing value-added taxes averaging 15 percent on our exports to them, while they rebate that value-added tax on their exports to us. Thus, the euro has almost doubled in value against the dollar in the Bush years, as NATO Europe begins to bail out on Iraq and Afghanistan.

We sat still as Japan protected her markets and dumped high quality goods into ours and China undervalued its currency to suck jobs, technology and factories out of the United States. Now, China and Japan have $2 trillion in cash reserves. The Arabs have an equal amount of petrodollars. Both are headed here to spend their depreciating dollars snapping up U.S. assets – banks, ports, highways, defense contractors.

America, to pay her bills, has begun to sell herself to the world.

Its balance sheet gutted by the subprime mortgage crisis, Citicorp got a $7.5 billion injection from Abu Dhabi and is now fishing for $1 billion from Kuwait and $9 billion from China. Beijing has put $5 billion into Morgan Stanley and bought heavily into Barclays Bank. ...

Open attacks on the business elite are seldom heard from mainstream White House candidates in America ... accuses lobbyists of "corrupting government

WASHINGTON, Jan 11 (Reuters) - Ask corporate lobbyists which presidential contender is most feared by their clients and the answer is almost always the same -- Democrat John Edwards.

...

But beyond his profession, Edwards' tone and language on the campaign trail have increased business antipathy toward him. His stump speeches are peppered with attacks on "corporate greed" and warnings of "the destruction of the middle class."

He accuses lobbyists of "corrupting the government" and says Americans lack universal health care because of "drug companies, insurance companies and their lobbyists."

...

Open attacks on the business elite are seldom heard from mainstream White House candidates in America, despite skyrocketing CEO pay, rising income inequality, and a torrent of scandals in corporate boardrooms and on Wall Street.

But this year Edwards is not alone. Republican candidate Mike Huckabee, former governor of Arkansas, sometimes also rails against corporate power and influence, tapping a populist current that lies just below the surface of U.S. politics. ...

U.S. exports of manufactured goods have increased ... factory jobs are down 212,000, or 1.5%, the worst year performance in four years

The unemployment rate jumped up to 5% last month, and non-government payrolls fell by 13,000, in a far weaker job report than was expected, according to the Bureau of Labor Statistics report on the labor market for December 2007. Total payrolls rose by 18,000 the weakest month for job growth since August 2003, the last month of the jobless recovery.

...

Manufacturing and construction both posted large negatives last month, down 31,000 and 49,000, respectively.

The sharp manufacturing job loss is another big disappointment from today's report. As the value of the U.S. dollar has declined in foreign markets, U.S. exports of manufactured goods have increased. These output gains have not yet, however, translated into job gains. To the contrary, last month's loss was the largest since August. Over the year, factory jobs are down 212,000, or 1.5%, the worst year performance in four years. Within manufacturing, the biggest losses are from the auto sector, down 6,300 over the month and 74,000 over the year. ...

A very small percentage of 2007’s new jobs required a college education ...private sector lost 13,000 jobs from the previous month

08/01/08 "ICH" -- - December did not bring Americans any jobs. To the contrary, the private sector lost 13,000 jobs from the previous month.

If December is a harbinger of the new year, it is going to be a bad one. The past year, hailed by Republican propagandists and “free trade” economists as proof of globalism’s benefit to Americans, was dismal. According to the Bureau of Labor Statistics’ nonfarm payroll data, the US “super economy” created a miserable 1,054,000 net new jobs during 2007. http://www.bls.gov/news.release/empsit.t14.htm

This is not enough to keep up with population growth--even at the rate discouraged Americans, unable to find jobs, are dropping out of the work force--thus the rise in the unemployment rate to 5%.

During the past year, US goods producing industries, continuing a long trend, lost 374,000 jobs.

But making things was the “old economy.” The “new economy” provides services. Last year 1,428,000 private sector service jobs were created.

Are the “free trade” propagandists correct that these service jobs, which are our future, are high-end jobs in research and development, innovation, venture capitalism, information technology, high finance, and science and engineering where the US allegedly has such a shortage of scientists and engineers that it must import them from abroad on work visas?

Not according to the official job statistics.

What occupations provided the 1.4 million service jobs in 2007?

Waitresses and bartenders accounted for 304,200, or 21% of the new service jobs last year and 29% of the net new jobs.

Health care and social assistance accounted for 478,400, or 33% of the new service jobs and 45% of the net new jobs. Ambulatory health care and hospitals accounted for the lion’s share of these jobs.

Professional and business services accounted for 314,000, or 22% of the new service jobs and 30% of the net new jobs. Are these professional and business service jobs the high-end jobs of which “free traders” speak? Decide for yourself. Services to buildings and dwellings account for 53,600 of the jobs. Accounting and bookkeeping services account for 60,500 of the jobs. Architectural and engineering services account for 54,700 of the jobs. Computer systems design and related services account for 70,400 of the jobs. Management consultants account for 88,400 of the jobs.

There were more jobs for hospital orderlies than for architects and engineers. Waitresses and bartenders accounted for as many of last year’s new jobs as the entirety of professional and business services.

Wholesale and retail trade, transportation, and utilities accounted for 181,000 of 2007’s new jobs. ...

What a super new economy Americans have! US job growth has a distinctly third world flavor. A very small percentage of 2007’s new jobs required a college education. Since there are so few jobs for university graduates, how is “education the answer”?

Where is the benefit to Americans of offshoring? The answer is that the benefit is confined to a few highly paid executives who receive multi-million dollar bonuses for increasing profits by offshoring jobs. The rest of the big money went to Wall Street crooks who sold trusting people subprime derivatives.

“Free traders” will assert that the benefit is in low Wal-Mart prices. But the prices are low only because China keeps its currency pegged to the dollar. Thus, the Chinese currency value falls with the dollar. The peg will not continue forever. The dollar has lost 60% of its value against the Euro during the years of the Bush regime. Already China is having to adjust the peg. When the peg goes, Wal-Mart shoppers will think they are in Neiman Marcus. ...

Recession in the US 'has arrived' ... according to a report from Merrill Lynch ... view is controversial

The feared recession in the US economy has already arrived, according to a report from Merrill Lynch.

It said that Friday's employment report, which sent shares tumbling worldwide, confirmed that the US is in the first month of a recession.

Its view is controversial, with banks such as Lehman Brothers disagreeing.

...

Sunday, January 6, 2008

"Corporate Greed has gotten its way in Washington for 25 years and our elected leaders let it happen. ...

"Corporate Greed has gotten its way in Washington for 25 years and our elected leaders let it happen. If we elect another president appointed by the status quo or just trade corporate Democrats for corporate Republicans the middle class will fall further behind and our children will pay the price." John Edwards

The corporate media over the last couple of months has been pushing a notion that John Edwards sounds "angry". Are we witnessing another attempt to take down a candidate that threatens the corporate power structure? Do we have a repeat of four years ago when the media made a big deal about Howard Dean shouting over the crowd noise?

John Edwards is angry and he has every right to be. All Americans should be angry at what is going on in our country. Our treasure is being sacrificed in an illegal unjust war in Iraq. Our jobs are being exported overseas. Health care costs are rising while wages decline. Our civil liberties have been threatened by an administration that thinks it is above the law. ...

Because opacity and rigged markets produce the desired goal of enriching the one percent who now own 44% of the wealth of the nation. ...

With each new revelation of multi-billion dollar losses from the largest Wall Street firms, there has been this nagging question as to how these Masters of the Universe got stuck with these massive write-downs. Isn't Wall Street supposed to execute trades for others; not build huge inventories of toxic, non-trading securities for themselves?

...

How could a layered concoction of questionable debt pools, many of dubious origin, achieve the equivalent AAA rating as U.S. Treasury securities, backed by the full faith and credit of the U.S. government, and time-tested over a century of panics, crashes and the Great Depression? (Despite the political rogues that come and go in Washington, we, the American people, show an inordinate and historical willingness to suffer fools and still pay our income taxes for the greater good of our fellow citizens. It doesn't hurt either that, in most cases, the tax is removed from our paycheck before we get it.)

How could an opaque instrument made up frequently of more than 100 hard to track pieces be safe enough for pension funds, insurance company funds and, disguised as commercial paper, stashed to the tune of over $50 billion in Mom and Pop money market funds?

How did a 200-year old "efficient" market model that priced its securities based on regular price discovery through transparent trading morph into an opaque manufacturing and warehousing complex of products that didn't trade or rarely traded, necessitating pricing based on statistical models?

...

The danger with Alice in Wonderland securities concocted by the invisible hand of a rigged machine, is that all it takes to start a panic is for some sober looking types in scholarly garb to step into the public square and yell "the Emperor has no clothes!"

...

Efficient markets need transparency and alert cops on the beat. Why is that so difficult to achieve? Because opacity and rigged markets produce the desired goal of enriching the one percent who now own 44% of the wealth of the nation. This one percent, in turn, keeps Congress on a short leash by holding the purse strings to campaign funding.

Wall Street is a two-sided market. The Wall Street firms' losses were another party's profits. Until we know where and how these profits were booked and the details of how the losses occurred, we are choosing to be the idiots of crony-capitalism. We are choosing to hand our country over to the robber barons. ...

Manufacturing Shrinks Most Since 2003

Jan. 2 (Bloomberg) -- Manufacturing in the U.S. shrank the most last month in almost five years, triggering speculation that the Federal Reserve will cut interest rates by half a percentage point to stave off a recession. ...

as many as 20 million householders may "walk" from them ...

...

That one company could downgrade 27 major financial institutions in one stroke is stunning, but it follows a swathe of credit downgrades that swept the US on Thursday and Friday.

...

The depth of the housing crisis was underscored by the head of one of America's largest banks, Bank of America, the straight-speaking Kenneth Lewis, who warned of a completely new attitude by Americans to their homes amid fears that as many as 20 million householders may "walk" from them, further deepening the crisis.

...

A number of factors are at work. First, many mortgage companies, encouraged by Alan Greenspan during 2002-03, ended mortgage deposit requirements.

Then the banks "sliced and diced" and sold the mortgages in packages so the householder no longer owed their payments to their bank but to anonymous international conglomerates.

Mortgage companies have also, by selling "liar's loans" and "toxic" mortgage debt, lost moral authority. Householders see no reason to be loyal to them. ...

China's cashed-up government is set to go shopping for more bargains ...

SHANGHAI (AFP) — Fresh from a five-billion-dollar investment in Morgan Stanley, China's cashed-up government is set to go shopping for more bargains as it takes advantage of the financial turmoil in the United States.

China's sovereign wealth fund created global headlines on Wednesday when it seized on Morgan Stanley's credit problems and grabbed a 9.9-percent stake in one of Wall Street's oldest and most storied investment firms. ...