Average length of unemployment highest since 1948. - WSJ.com | The Economy Is Even Worse Than You Think | The average length of unemployment is higher than it's been since government began tracking the data in 1948.

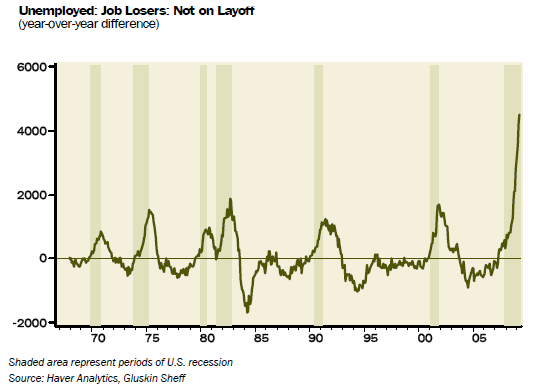

The Bureau of Labor Statistics preliminary estimate for job losses for June is 467,000, which means 7.2 million people have lost their jobs since the start of the recession. The cumulative job losses over the last six months have been greater than for any other half year period since World War II, including the military demobilization after the war. The job losses are also now equal to the net job gains over the previous nine years, making this the only recession since the Great Depression to wipe out all job growth from the previous expansion.

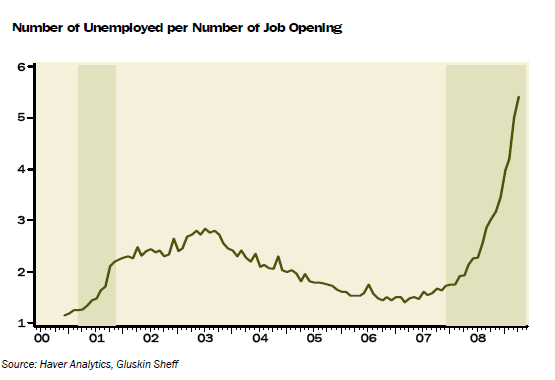

Here are 10 reasons we are in even more trouble than the 9.5% unemployment rate indicates:

- June's total assumed 185,000 people at work who probably were not. ...

- More companies are asking employees to take unpaid leave. These people don't count on the unemployment roll.

- No fewer than 1.4 million people wanted or were available for work in the last 12 months but were not counted. ...

- The number of workers taking part-time jobs ... has doubled ... to about nine million, or 5.8% of the work force. ...

- The average work week ... in the private sector ... slipped to 33 hours. ... Full-time workers are being downgraded to part time ...

- The average length of official unemployment increased to 24.5 weeks, the longest since government began tracking ...

- The average worker saw no wage gains in June, with average compensation running flat at $18.53 an hour.

- The goods producing sector is losing the most jobs -- 223,000 in the last report alone.

- The prospects for job creation are equally distressing. ...

Job losses may last well into 2010 to hit an unemployment peak close to 11%. That unemployment rate may be sustained for an extended period. ...

Mr. Zuckerman is chairman and editor in chief of U.S. News & World Report.