Right wing economists have their statistics to tell them when an economy is doing well. If millions of people are jobless, homeless, starving or dying, it matters not. If the statistics point in the right direction and the rich are getting richer,

...

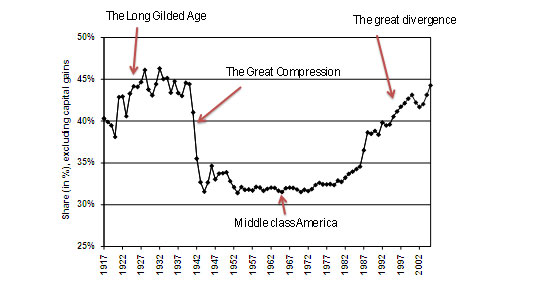

FDR’s New Deal consisted of numerous statutes that served to greatly reduce income inequality and improve the economic prosperity of the vast majority of Americans. This chart graphically shows the period of relative economic equality, which is denoted as the percent of income made by the richest 10% of Americans:

That period began in the late 1930s, as FDR’s New Deal policies began to take effect, with the percent of annual wealth made by the top 10% of Americans plunging from about 45% to about 32% (while median income greatly increased). There it remained until the “Reagan Revolution” of the early 1980s, which was characterized by a concerted and largely successful effort to dismantle FDR’s New Deal. Under George Bush II, income inequality in the United States has now attained unprecedented proportions.

...

I am not against income inequality per se. If it resulted in benefits for everyone (as in, “a rising tide lifts all boats”) or if it fairly represented the amount or value of the work that people did, I would have a very difficult time arguing against it. But the opposite of those scenarios seems to be the reality of the situation. Petras explains:

One measure of the enormous influence of the financial ruling class in heightening the exploitation of labor is found in the enormous disparity between productivity and wages. Between 2000 and 2005, the US economy grew 12 percent, and productivity (measured by output per hour worked) rose 17 percent while hourly wages rose only 3 percent. Real family income fell during the same period… Three quarters of Americans say they are either worse off or no better off than they were six years ago…. The growth of vast inequalities between the yearly payment of the financial ruling class and the medium salary of workers has reached unprecedented levels…. In 2005 the proportion of national income to GDP going to… non-wage and salary sources was at record levels – 43 percent. Inequality in the distribution of national income in the US is the worst in the entire developed capitalist world….

So why has this happened? I cannot explain it well, but Petras offers some insights which I believe explain a lot of it:

A vast army of workers, peasants and salary employees produce value which becomes the basis for… speculative financial instruments. The transfer of value from the productive activities of labor up through the trunk and branches of financial instruments is carried out through various vehicles… credit, debt leveraging, buyouts and mergers… The financial sector acts as combined intermediary, manager, proxy-purchaser and consultant, capturing substantial fees, expanding their economic empires. Finance capital is the midwife of the concentration and centralization of wealth and capital as well as the direct owner of the means of production and distribution. Finance capital has moved from exacting a larger and larger ‘tribute’ (commission or fee) on each large-scale financial transaction, toward penetrating and controlling an enormous array of economic activities…

Or, to summarize it in my unsophisticated economic language, producers produce goods and services and the financial elite, through a variety of complex financial mechanisms, find a way to… uh …. have the money transferred to themselves. ...

No comments:

Post a Comment