As we usher in the New Year the filthy rich are counting their blessings and must be very appreciative of the massive bailouts that protected their wealth. The top one percent of this country control 42 percent of all financial wealth so it shouldn’t come as any surprise that most of the bailouts went to Wall Street and those that are tethered to it for income. As the stock market continues to rally Americans collecting food stamps stands at the highest number ever at 37 million. We also have 27 million Americans looking for work or are simply stringing a few hours together to keep some sort of paycheck coming in. The vast majority of Americans are simply exhaling a sigh of relief that the 2000s are now a thing of the past. Yet if something isn’t changed radically in our system we are bound to enter another financial shock in the near term.

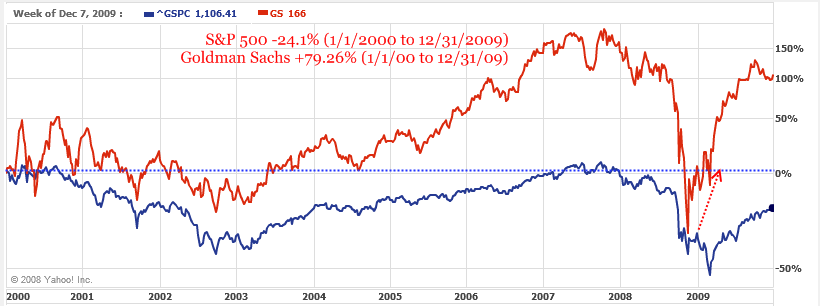

First, the S&P 500 is down a stunning 24.1 percent since the start of the decade. Yet Goldman Sachs managed to pull off almost an 80 percent gain during the same time:

So for the poor average American who simply dollar cost averaged into the stock market as every good corporatocracy banker would tell them, they would have fallen behind someone who simply dollar cost averaged into their mattress. .......

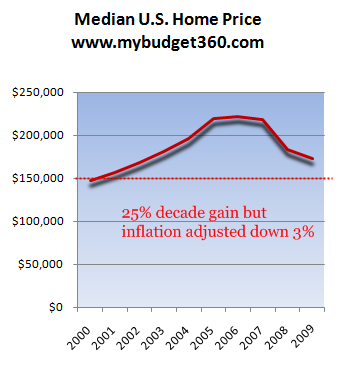

How did the housing market do?

The median U.S. home price in November of 1999 came in at $137,600 and ended November 2009 at $172,600. This 25 percent gain is wiped out once we factor in the Federal Reserve inflating away the U.S. Dollar. Housing over the decade is actually down 3 percent. This is where the largest store of the average American wealth is stashed and it went negative for the decade. Yet somehow the ultra rich seemed to make out like bandits with all the bailouts even though are economy was still fizzling out from two mega bubbles. There is a reason they call it a golden parachute. ...

...

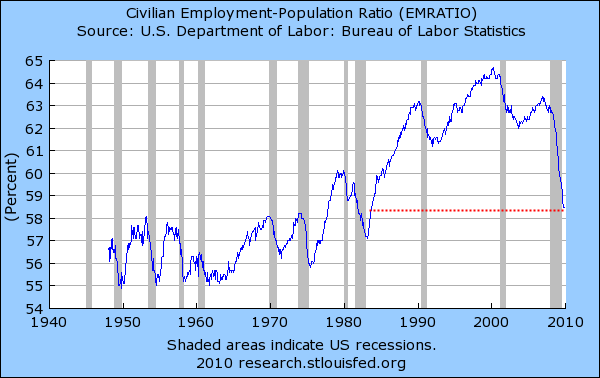

So how did Americans do over the decade in the employment front?

The unemployment rate is the highest it has been since the early 1980s. If we look at the employment population ratio we will see that our economy is still trending to the downside. Yet the corporatocracy is happy to feed the propaganda line that the average American is better off. Really? How so?...

or example, last month I was stuck by a “savings withdrawal fee” from Chase. I never saw this before. So I called up the bank and asked them what this was. It amounted to a $12 fee for each transaction. As it turns out, the wonderful Federal Reserve through Regulation D yanks money out for people making more than 6 ACH transfers per month from savings accounts. So if you wanted to move your money from say your toxic too big to fail bank to say a local community bank, make sure you don’t do more than 6 transfers for the month or you are going to be hit with a $12 fee for this. Insane policies like this make me realize that something is going to give in this decade.

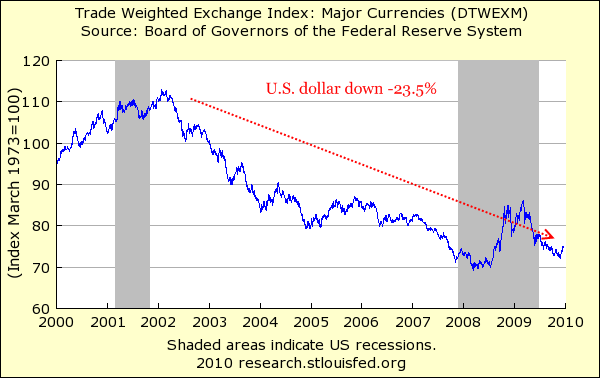

But over the decade our U.S. dollar must have gone up right? Let us take a look:

The U.S. dollar is down 23.5 percent for the decade. So if any of you actually left the country and spent abroad you would quickly realize how weak the dollar has gotten....

No comments:

Post a Comment