...

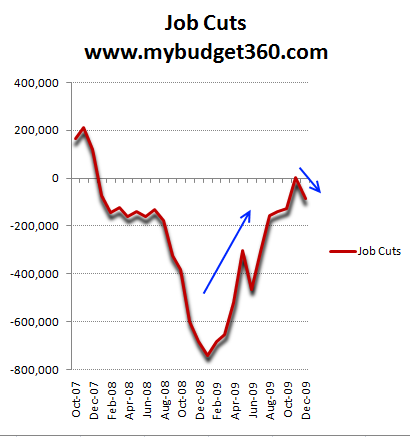

Even in the last headline unemployment reading, we lost 85,000 additional jobs and October job losses were revised upward from 111,000 to 127,000 yet the big focus was on the preliminary 4,000 job gain in November. This is what passes as news to rally the market in today’s market.

In fact, the S&P 500 70 percent rally comes parallel to us losing jobs for 25 straight months:

We have lost over 7.2 million jobs officially (8 million once the February revision is put in) and yet the market keeps moving up. Why? Because the banking system is using every ill gotten penny to gamble in futures, derivatives, and every other financially toxic product while the average American continues to bailout their gambling ways. Andrew Carnegie at least left us with steel and a solid infrastructure for economic growth when he amassed his wealth. What has the banking sector with financial innovation left us over the last few decades? It has left this country with the destruction of the U.S. dollar, a lost decade in jobs, an imploded housing bubble, and double-digit unemployment. Isn’t the verdict clear? The banking sector has been an abject failure. The symbiotic bond between our government and Wall Street is so tightly woven, that people go in and out of Wall Street and public sector jobs as if it were a revolving door. This is our new form of government and at the core is the corporatocracy. A government bought by Wall Street and for Wall Street. The interest of the people only comes into question if there is money left over after bonuses. ...

No comments:

Post a Comment